The basics of a Traditional IRA account

What is a Traditional IRA?

A Traditional IRA is an individual retirement account in which your contributions may be tax-deductible. Your earnings, if any, are tax-deferred and will be included in your taxable income at the time of withdrawal.

Who is a Traditional IRA account for?

Anyone with taxable compensation can open a Traditional IRA account. Your contributions may be fully or partially deductible, depending on your filing status and income.

Why invest in a Traditional IRA?

A key advantage of a Traditional IRA account is the potential ability to reduce your taxable income as you save for retirement. Generally, your Traditional IRA earnings won’t be taxed until you take a distribution from your IRA.

Benefits of a Traditional IRA account with J.P. Morgan

Holistic view

Consolidate your eligible 401(k) or other retirement accounts and keep track of your investments—in the Chase Mobile® app or at chase.com.

Personalized advice

Work with our J.P. Morgan advisors to help design a retirement strategy based on what’s important to you.

Powerful tools

Use J.P. Morgan Wealth Plan® to set and track your retirement goals, and get personalized insights to guide you on your journey.

Thousands of investments

Once you open the right IRA account for your needs, you can choose from a wide range of stocks, ETFs, fixed income, mutual funds and options.

Start your investment journey

Get started with a J.P. Morgan Traditional IRA account. You can open one on your own or you can work with our advisors.

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

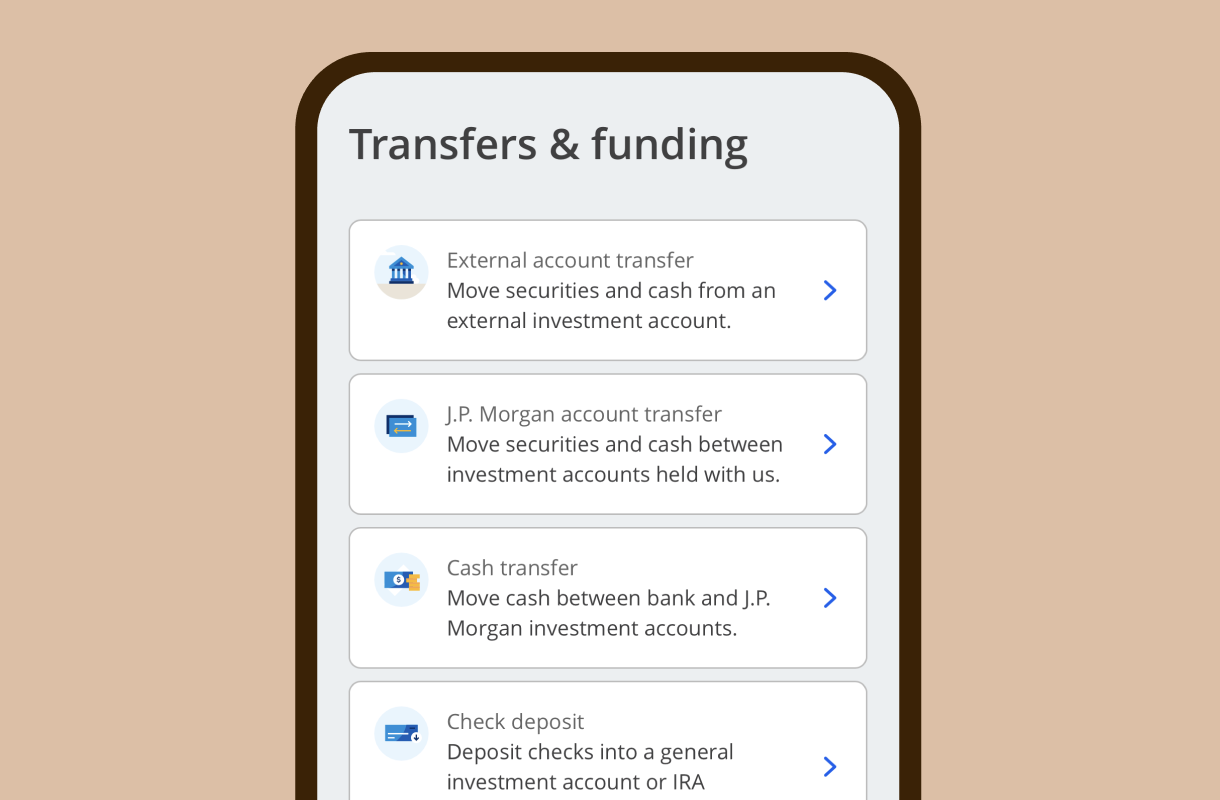

Looking to consolidate? Roll over or transfer external accounts

Keep your retirement savings in one place by rolling over your 401(k) and other employer-sponsored retirement accounts or transferring external IRAs to a J.P. Morgan IRA.

Stay on track with our retirement tools

Retirement calculators

From 401(k) planners to IRA calculators, our calculators can help you run the numbers, compare tax implications and much more.

Already have a Traditional IRA account with J.P. Morgan?

Make a contribution

Make a one-time contribution or set up recurring transfers—from your Chase checking or savings accounts into your IRA.

Track your portfolio’s performance

Track and compare your portfolio’s performance relative to major indices, including the Consumer Price Index to measure against inflation.

Frequently asked questions

A Traditional IRA is a retirement account where your contributions may either be tax-deductible or non-deductible, and your earnings and any previously deducted contributions will be included in your taxable income when you withdraw your money.

Traditional IRA contributions may be tax-deductible for the year for which they are made. Deductibility for a Traditional IRA contribution may be limited based on your income tax filing status, if your modified adjusted gross income (or “MAGI”) exceeds certain levels, and if you or your spouse are covered by a workplace retirement plan.

The IRS sets annual contribution limits for Traditional IRAs and Roth IRAs. For 2025, the annual maximum is $7,000 if you are under the age of 50, or $8,000 if you are 50 or above. Learn more.

While eligibility for a tax deduction is dependent on income and involvement in other employer plans, you can contribute at any age if you (or your spouse, if filing jointly) have taxable compensation.

You may withdraw from a Traditional IRA at any time; however, withdrawals from your Traditional IRA are includible in your taxable income and if you are under age 59 ½ you may have to pay an additional 10% tax for early withdrawal unless you qualify for an exception.

A rollover IRA is an IRA that is set up to accept assets from an employer-sponsored plan like a 401(k) or 403(b) once you have a qualifying distributable event (such as changing employers or retiring). The rollover IRA could be either a Traditional or Roth IRA depending on the circumstances.

Traditional and Roth IRAs both offer a way to save for retirement that give you tax advantages.

A Traditional IRA is an individual retirement account where your contributions may be tax-deductible, and you pay taxes when you withdraw your money. Potential earnings grow tax-deferred until withdrawal. Traditional IRAs are subject to the IRS’ required minimum distribution (RMD) rules.

A Roth IRA is an individual retirement account where you contribute after-tax dollars, and you don’t have to pay federal tax on “qualified distributions,” including potential earnings, if certain criteria are met. Roth IRAs of original account owners are not subject to the IRS’ RMD rules. Learn more about their key differences and how each of these IRAs may meet your needs.

You can easily open a Traditional IRA online or with a J.P. Morgan advisor. Once you fill out an application and are approved, you’re ready to start making contributions (if eligible) and investing in mutual funds, bonds, stocks and exchange-traded funds (ETFs).