Financial planning and advice that’s built around you

Personalized financial planning

Partner with an advisor to build a strategy based on what's important to you—whether that's paying off debt, early retirement or saving for a purchase.

Advice when you need it

Get matched to an expert-built portfolio with automated tax-smart technology, and receive ongoing advice and annual check-ins to ensure your plan is on track.

Team of advisors

Our team of advisors will always act in your best interest so you can be confident that any advisor you work with is committed to prioritizing your financial goals.

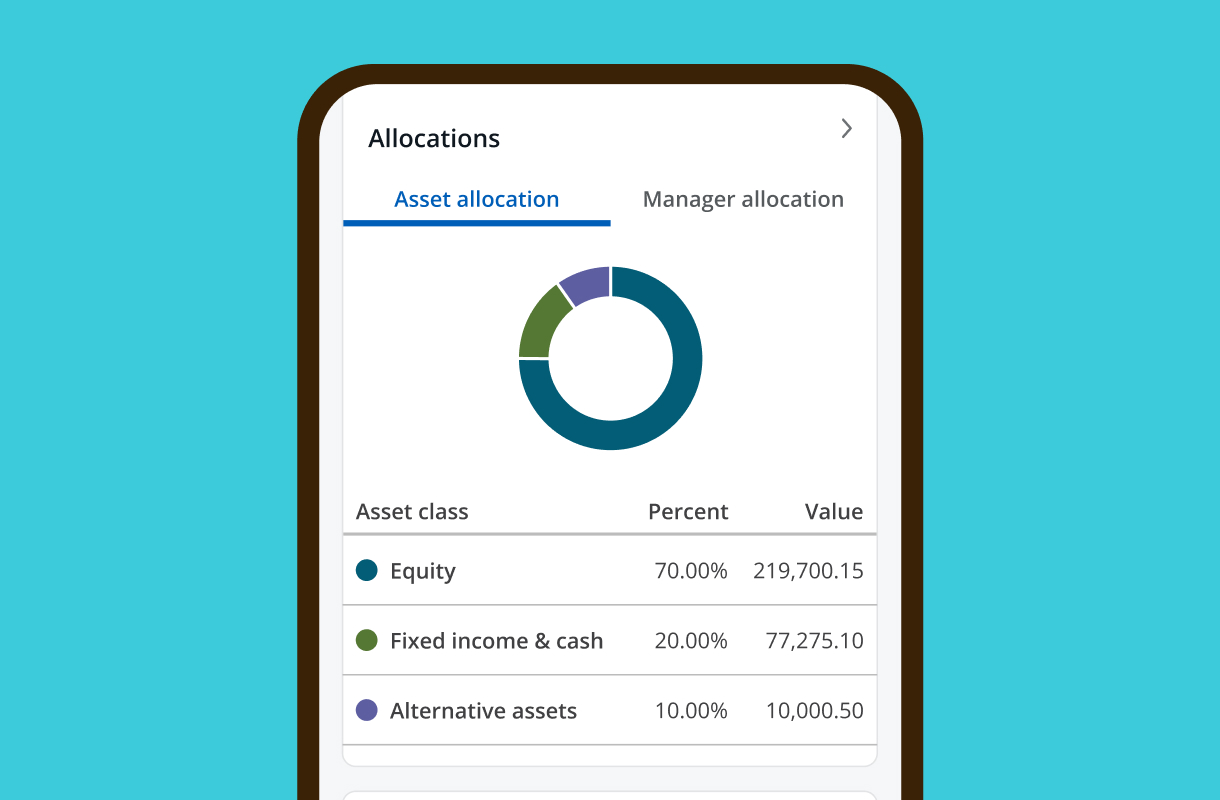

Holistic view

Manage all of your banking, investing and borrowing, and conveniently transfer money online and in the Chase Mobile® app.

Get started today

By providing your mobile number, you are giving permission to be contacted at that number about your investment contact form. Your consent allows the use of text messages, artificial or prerecorded voice messages, and automatic dialing technology for informational and account service, but not for sales or telemarketing. Message and data rates may apply, message frequency varies. You can opt out of receiving messages at any time by texting STOP or you can text HELP for more info. Terms and Conditions & Privacy Policy.

*All form fields required

Click “continue” once to have a J.P. Morgan team member contact you. J.P. Morgan Personal Advisors clients generally have $25,000 or more in investable assets.

Here's how we will work together

We’ll get to know you

We take time to get to know your priorities—from big goals to small goals—and create a personalized financial plan tailored to where you are and what you want to achieve in the future.

Then, we’ll help match you to the right portfolio

Once we understand your full financial picture, risk tolerance and time horizon, we’ll recommend a professionally designed investment portfolio that can help meet your needs.

We'll help you make your money work harder

Our tax-loss harvesting technology helps you make tax-smart decisions automatically to potentially keep more of your returns with no added effort and no additional charge.

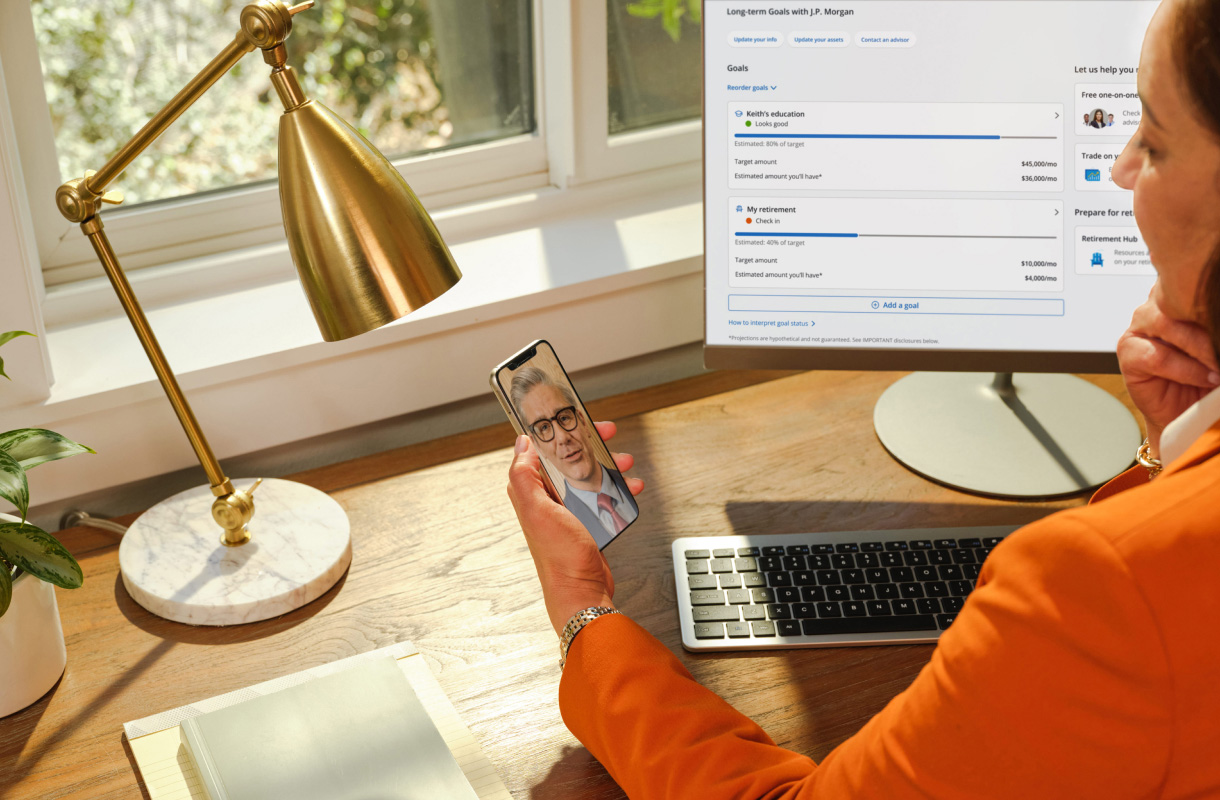

And we’ll collaborate online

Our award-winning J.P. Morgan Wealth Plan® allows you to track your progress in real time and work with your advisors to adjust your financial strategy as your goals change. You can even schedule a meeting in the Chase Mobile® app or at chase.com.

Clear, straightforward fees

Move the slider to estimate your advisory fee.

- currentInvest from $25,000 to $249,999:0.6% annual fee

- Invest over $250,000:0.5% annual fee

Move the slider to estimate your advisory fee.

year

Annual advisory fees do not include operating expenses on the investments in your portfolio—fees similar to what you would pay if you invested on your own.

Get your free one-on-one investment consultation

Speak with a J.P. Morgan team member to get started.

Frequently asked questions

During your first meeting, an advisor will take the time to get to know you and your priorities, understand your goals and begin to develop your personalized financial plan.

You'll be matched with an advisor to help you with the account setup process; once your account is created, you may work with a different advisor in future meetings. Our team of advisors act as fiduciaries, meaning no matter who you work with, you can be confident that all our advisors have your best interests at heart.

Depending on your investment amount, you'll pay an annual fee between 0.6% and 0.5% of the assets in your account. Annual advisory fees don’t include operating expenses on the investments in your portfolio, which are fees similar to what you would pay if you invested on your own.

Our advisors take the time to get to know your priorities—from big goals to small goals—and create a personalized financial plan tailored to where you are now, and what you want to achieve in the future. Once we understand your financial picture, risk tolerance and time horizon, we'll recommend expert-built investment portfolios that help meet your needs.

As life changes, so will your financial goals. Simply schedule a meeting with one of our advisors, and we’ll make the necessary adjustments to your strategy to help meet your new goals.

Personal Advisors gives you access to a team of advisors who will work to help you create a personalized financial plan to achieve your goals. Then, you'll be matched to expert-built portfolios and will receive ongoing advice from our J.P. Morgan team members over video or phone—all for an annual fee of 0.6% or less. Your account also unlocks industry insights and exclusive research from J.P. Morgan specialists to help you make the most of your account.

With J.P. Morgan Personal Advisors, you'll have access to a team of advisors and you’ll be matched to expert-built portfolios designed to help you meet your goals. J.P. Morgan Private Client Advisor allows you to work one-on-one with an advisor in your local community to build a custom investment strategy.

Our advisors will take you through the account setup process at a pace that's right for you. Together we'll build your personalized financial plan, and decide which portfolios are right for you. Then you'll submit your account application to start funding. This process can take anywhere from 2 to 3 meetings.

Personal Advisors’ tax-loss harvesting technology automatically sells investments at a loss and uses those losses to offset gains to help you potentially keep more of your investment returns. Learn more.

Personal Advisors automatically applies tax-loss harvesting services for all taxable accounts. There is no added effort needed from you, and there is no additional charge for the service.

Sharpen your knowledge with the latest news and market commentary

Tap into the latest news and subscribe for market commentary and analysis from J.P. Morgan specialists to help you plan your investment strategy and learn about opportunities.

Explore more ways to invest

INVEST ON YOUR OWN J.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

INVEST ON YOUR OWN J.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

WORK ONE-ON-ONE WITH AN ADVISOR J.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.

WORK ONE-ON-ONE WITH AN ADVISOR J.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.