INVESTING GOALSEducation planning for you and your family

Wherever you are on your path toward saving for school, our advisors can help you stay on track toward your education goals.

To get started, call 1-833-542-2474 to speak to a J.P. Morgan team member Monday–Friday from 8 AM to 9 PM ET and Saturday from 9 AM to 5 PM ET. Or fill out a form and we’ll contact you.

Prepare for today and tomorrow

Define your education goals

We take the time to understand your priorities and map out a strategy tailored to who you are, where you are and where you want to go.

Explore your funding options

We can help you evaluate your saving, investing, borrowing and financial aid options to determine what would work best for you and your family.

Put your strategy to work

Based on your goals, we can help you create a strategy that may reduce taxes and offer opportunity for compound growth.

Adapt as change comes your way

We’ll help you track your progress and make adjustments as your goals and financial situation evolves over time.

Here’s how we can help you plan for your family’s future

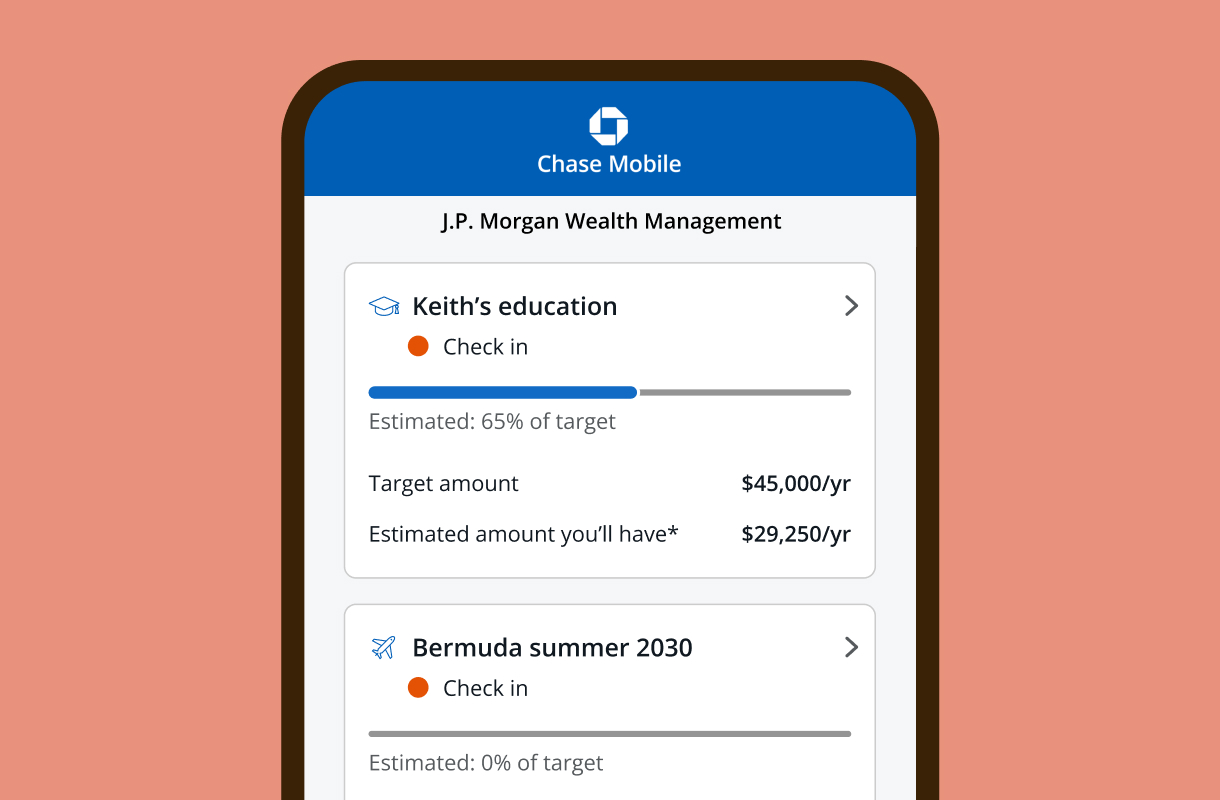

Keep your goals in sight with Wealth Plan

J.P. Morgan Wealth Plan® is our award-winning digital money coach that makes it easy to set and track your education goals and offers insights to guide you, every step of the way.

IMPORTANT: The projections or other information generated by Wealth Plan regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Start your education planning today

Call 1-833-542-2474 to speak to a J.P. Morgan team member Monday–Friday from 8 AM to 9 PM ET and Saturday from 9 AM to 5 PM ET. Or fill out a form and we’ll contact you.

Learn more about your funding options

What it is

A tax-advantaged investment product for education that has a low impact on financial-aid eligibility.

Benefits

- Many state plans offer a state income tax deduction for contributions made by in-state residents.

- It may be applied to K-12 tuition (up to $10,000 per year), vocational school, registered apprenticeships, college, graduate school and student loans (up to $10,000 in total).

- Investments grow tax-deferred.

- Withdrawals are not subject to federal tax (when used for qualified education expenses)

- You can “front-load” your contributions by making five years’ worth of gifts in a single year.

- Easy to establish and maintain.

- Beginning in 2024, a 529 plan beneficiary can roll over up to a lifetime maximum of $35,000 in 529 plan funds into their own Roth IRA (subject to Roth contribution limits but not subject to income limitations) without paying taxes or penalties. The 529 plan must have been open for a minimum of 15 years and the assets being rolled into a Roth IRA must have been in the 529 for at least 5 years.

Disadvantages

- You're limited to the investment options offered by the 529 plan.

- Using annual exclusion gifts to fund a 529 account precludes use of the annual exclusion amount for other purposes.

- Some states don’t recognize certain expenses (primarily K-12 tuition) as qualified; withdrawals for those expenses may incur state income tax.

Schedule a meeting with your J.P. Morgan Private Client Advisor to open a 529 plan today. If you don’t have an advisor, fill out a form to set up a free one-on-one consultation.

What it is

A tax-advantaged investment product for education that has a low impact on financial aid eligibility.

Benefits

- Earnings accrue free of income tax.

- Distributions may be made free of income tax as long as they're made for qualified education expenses.

- Assets may be used to purchase many different types of investments, including stocks, bonds and mutual funds.

- Easy to establish and maintain.

Disadvantages

- The maximum contribution is limited to $2,000 per year, per beneficiary. The $2,000 contribution maximum is gradually phased out if your modified adjusted gross income falls between $190,000 and $220,000 ($95,000 and $110,000 for single filers).

- Contributions must be made before the beneficiary reaches age 18.

What it is

Types of custodial accounts that can be used for a child's general benefit, not only for education.

Benefits

- The custodian controls the account and can invest the account’s assets in any manner they choose.

- The custodian can choose whether or not to use custodial assets to pay for the minor’s expenses.

- Most states now use UTMA rather than UGMA. South Carolina is the only state that doesn’t offer UTMA accounts, although you can still open a custodial account under the South Carolina UGMA.

Disadvantages

- Custodial accounts are considered assets of the minor and must be turned over to them when they reach the age of majority (usually either 18 or 21 depending on your state of residence).

- Since they are the minor’s assets, custodial accounts could potentially limit financial aid eligibility.

- Using annual exclusion gifts to fund an UTMA or UGMA account may prevent the use of the exclusion for other purposes.

- Income from these accounts is typically taxed at the same rate as the parents.

What it is

There are various financial aid packages, from scholarships to federal student loans, which you’ll most likely need to renew annually. These options can be used to supplement your education savings.

Benefits

- Often, grants and scholarships don't have to be paid back.

- Federal student loans are easy to apply for and offer flexibility when it comes to repayment.

- Student loan interest can be tax-deductible.

Disadvantages

- Merit-based scholarships can be very competitive and not everyone qualifies.

- Only 0.3% of students receive enough free aid to completely cover their education.

- 32% of financial aid is disbursed through federal loans that need to be paid back with interest.

- Today, a record 4 in 10 households owe student loan debt.

- It is generally more difficult to discharge student loan debt than other forms of debt, even in bankruptcy.

Sharpen your knowledge with the latest news and market commentary

Tap into the latest news and subscribe for market commentary and analysis from J.P. Morgan specialists to help you plan your investment strategy and learn about opportunities.