Tax-advantaged IRAs can help you retire with confidence

A J.P. Morgan Individual Retirement Account (IRA) offers a strategic way to save for retirement with a range of investment options and expert guidance tailored to your needs.

The basics of IRA accounts

What is an IRA?

An individual retirement account (IRA) is a tax-advantaged account that can help individuals save for retirement. Two of the most common types of IRAs are Traditional and Roth.

Why invest in an IRA?

Available at any career stage, an IRA is for individuals with taxable compensation who are planning for retirement. The tax advantages of an IRA may make it a smart way to save for your future.

What can I invest in with an IRA?

Our Traditional and Roth IRAs offer $0 commission online trades and a wide range of investment options, including mutual funds, stocks and ETFs.

Explore types of IRAs at J.P. Morgan

Traditional IRA

Your contributions may be tax-deductible. Your earnings, if any, are tax-deferred and will be included in your taxable income at the time of withdrawal.

Roth IRA

Your contributions are not tax-deductible. Your earnings, if any, are tax-deferred and may be withdrawn tax-free if certain conditions are met.

Want to see all the details? View our IRA comparison PDF

Benefits of an IRA account with J.P. Morgan

Holistic view

Consolidate your eligible 401(k) or other retirement accounts and keep track of your investments—in the Chase Mobile® app or at chase.com.

Personalized advice

Work with our J.P. Morgan advisors to help design a retirement strategy based on what’s important to you.

Powerful tools

Use J.P. Morgan Wealth Plan® to set and track your retirement goals, and get personalized insights to guide you on your journey.

Thousands of investments

Once you open the right IRA account for your needs, you can choose from a wide range of stocks, ETFs, fixed income, mutual funds and options.

Start your investment journey

You can open a J.P. Morgan IRA account on your own or you can work with our advisors.

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

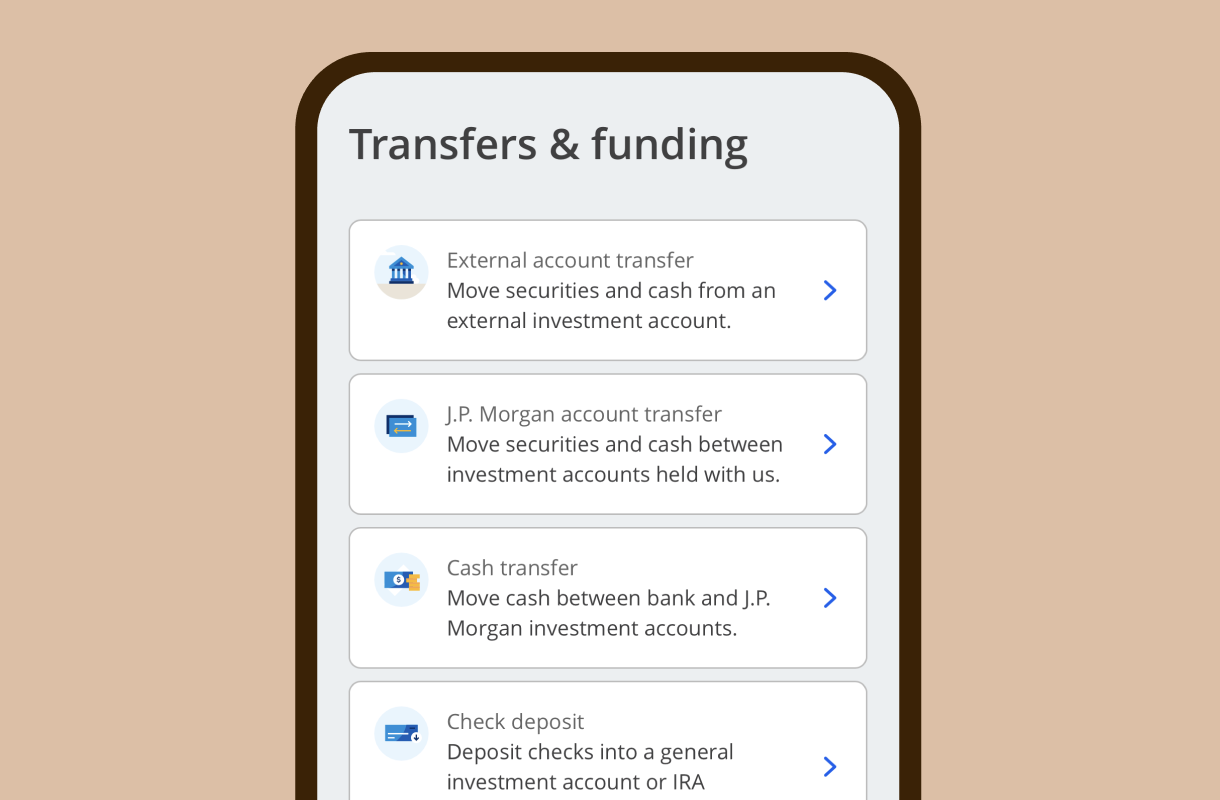

Looking to consolidate? Roll over or transfer external accounts

Keep your retirement savings in one place by rolling over your 401(k) and other employer-sponsored retirement accounts or transferring external IRAs to a J.P. Morgan IRA.

Stay on track with our retirement tools

Already have an IRA account with J.P. Morgan?

Make a contribution

Make a one-time contribution or set up recurring transfers—from your Chase checking or savings accounts into your IRA.

Track your portfolio’s performance

Track and compare your portfolio’s performance relative to major indices, including the Consumer Price Index to measure against inflation.

Frequently asked questions

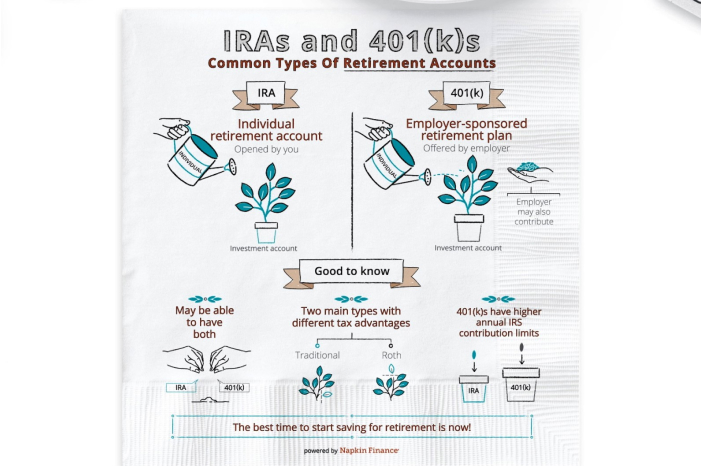

IRA stands for individual retirement account, which is distinct from a workplace retirement account, such as a 401(k).

An individual retirement account, or IRA, is a tax-advantaged way of saving for retirement. A company's 401(k) may not be enough to help you reach your financial milestones, so also contributing to an IRA can help bring you closer to your retirement goals. The two main types of IRAs are Traditional and Roth.

Traditional and Roth IRAs are types of IRA accounts that offer different ways to save for retirement.

A Traditional IRA is an individual retirement account where your contributions may be tax-deductible, and you pay taxes when you withdraw your money. Potential earnings grow tax-deferred until withdrawal. Traditional IRAs are subject to the IRS’ required minimum distribution (RMD) rules. For individuals age 73 and older who have a Traditional IRA, RMDs must begin by April 1 of the year following the year you turn 73 and must be taken by December 31 of each year after the year you turn age 73.

A Roth IRA is an individual retirement account where you contribute after-tax dollars, and you don’t have to pay federal tax on “qualified distributions,” including potential earnings, if certain criteria are met. Roth IRAs of original account owners are not subject to the IRS’ RMD rules. Learn more (PDF) about their key differences and how each of these IRAs may meet your needs.

The IRS sets annual contribution limits for Roth IRAs and Traditional IRAs. For 2025, the annual maximum is $7,000 if you are under the age of 50, or $8,000 if you are 50 or above. Learn more.

Note that you may be able to contribute to both an IRA and your company’s 401(k) or other employer sponsored retirement account.

Yes, you can transfer an an existing IRA to your J.P. Morgan IRA. Learn more about transferring your external IRA and other investments to a J.P. Morgan investment account.

How much you need to retire depends on many factors including when you retire and your expected cost of living, so it’s often a good idea to work with a financial professional to help determine how much you may need. You can also use our helpful retirement calculator to estimate your future savings.

You can easily open an IRA online or with a J.P. Morgan advisor. Once you fill out an application and are approved, you’re ready to start making contributions (if eligible) and investing in mutual funds, bonds, stocks and exchange-traded funds (ETFs).