Diversify your investment portfolio with fixed income

Reimagine your approach to corporate and municipal bonds, treasury bills, and certain mutual funds with J.P. Morgan Wealth Management.

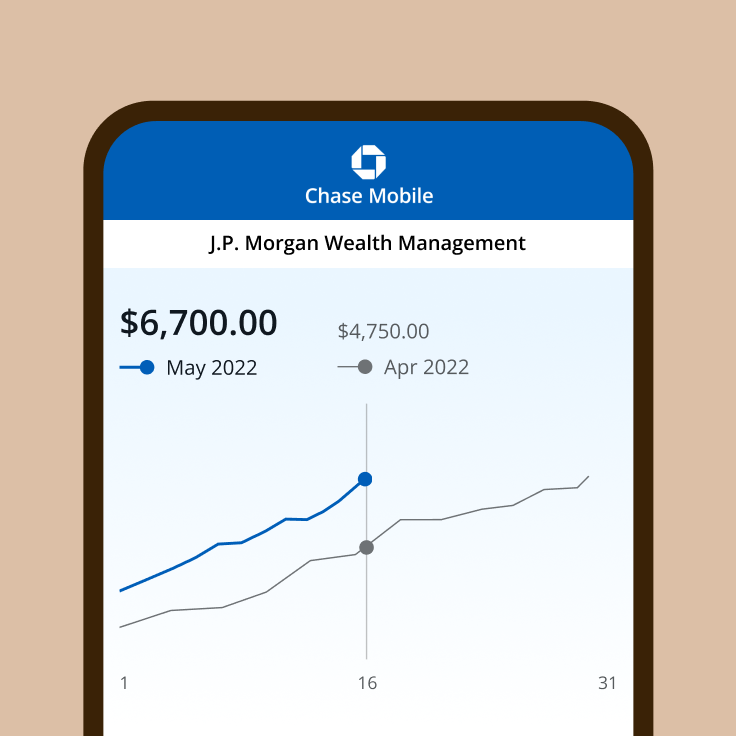

Already have a J.P. Morgan account? Keep an eye on your investments and review your portfolio to help you reach your goals.

Learn more about fixed income

What are fixed income investments?

Fixed income investments provide investors a stream of fixed or variable periodic interest payments and the eventual return of principal upon maturity. They are debt instruments issued by governments, corporations or other entities, typically to finance and/or expand their operations. Key risk considerations are issuer and interest rates risks.

Who are fixed income for?

Traditional fixed income investments provide consistent streams of income. They can also help diversify a portfolio as they can serve as a ballast in times of market volatility.

Why invest in fixed income?

Investing in fixed income investments, such as bonds, can help generate income, preserve capital and support your overall investment goals.

Why invest in fixed income with J.P. Morgan

- Explore the pros and cons of fixed income investments with J.P. Morgan’s expertise and investment tools.

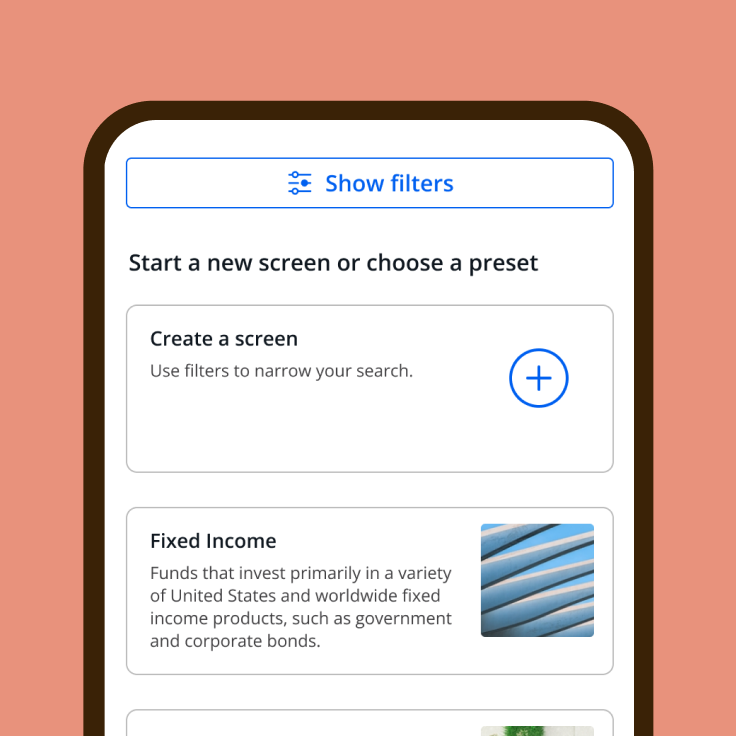

- From treasury’s to bond-exposed ETFs, choose from a wide range of fixed income securities.

- Tap into J.P. Morgan Research for actionable insights into helping you choose a fixed income portfolio.

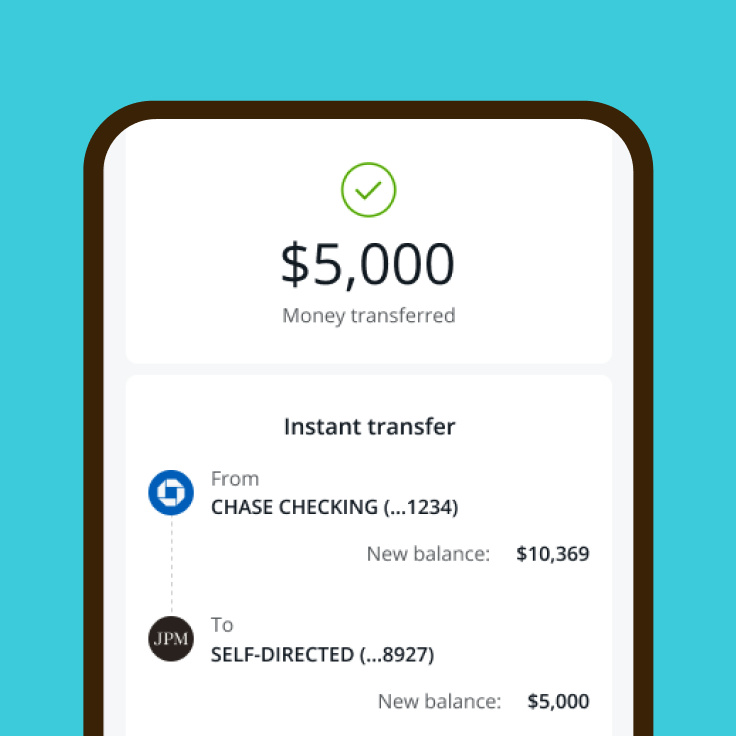

- Download the Chase Mobile® app to manage and monitor your fixed income investments on the go.

Invest on your own

Manage your portfolio online with intuitive tools to help you buy, sell and adjust your investments.

Learn more about our other investment products and accounts

Frequently asked questions

Fixed income investing is a common way of diversifying your investment portfolio. Investing in fixed income can help offset the market volatility more typically associated with stocks.

Investing in bonds is the most typical fixed income investment. Bonds are loans made by investors to governments and corporations to help raise capital for projects and other expenditures. Investing in bonds and other fixed income investments is a common way to diversify your investment strategy.

The most common types of fixed income investments are bonds, and they come in different forms depending on the issuing entity:

- Government bonds, which include U.S. Treasury bonds and U.S. savings bonds, are backed by the federal government. While potentially vulnerable to inflation and changes in interest rates, they are generally considered low risk. They range from short-term Treasury bills (“T-bills”), which mature within one year of issue, to 30-year Treasury bonds (“T-bonds”).

- Municipal bonds are issued by local governments to raise funds for capital projects. Plus, interest earned from municipal bonds is generally exempt from federal tax.

- Corporate bonds are issued by companies that wish to raise money without diluting stock or relying on institutional loans. The issuing organization’s credit rating helps determine the relative risk of the bond. Corporations with excellent credit ratings offer what are known as investment-grade bonds. Businesses with lower credit ratings typically issue high-yield bonds, also known as junk bonds. High-yield bonds tend to carry more risk and consequently offer higher interest rates.

A debt instrument is an asset that organizations use to raise capital from investors. Fixed income investments are a type of debt instrument that return a fixed amount of interest to investors. The principal is returned to the investor when the instrument, typically in the form of a bond issued by a government, municipality or corporation, reaches maturity.

Bonds are also known as fixed income investments because they provide a form of fixed income to investors. This fixed income often comes in the form of regular (typically annual or semiannual) payments, sometimes known as coupon payments.

If you hold your bond through maturity, you normally receive the principal back at the face value you paid for it. However, if you decide to sell your bond prior to maturity, you may lose or gain against the principal depending on the market rate of the bond at the point of sale.

To invest in bonds, you typically need a brokerage account, though government-issued bonds can be bought directly through official websites. As with stocks, bonds can be purchased individually, or you can invest in a mutual fund or ETF that is exposed to the bond market. You can invest in bonds through an advisor or online.

When investing in fixed income, please consider the investment objectives, risks, charges, and expenses associated with the funds before investing. Investment can lose value and those losses are not covered by SIPC.

Some examples of risks to consider are:

Interest rates: fluctuation in interest rates have a positive or negative effect on bond values. Understand your desired duration.

Credit quality and yield: issuers may default on the bond and may not make further income and/or principal payments

Sharpen your knowledge

A spotlight on bonds

Investing in bonds can help diversify a portfolio, provide investors with fixed income and potentially hedge against an economic slowdown.

Have you reassessed the role of bonds in your portfolio? You should.

In a time of uncertainty and volatility, it makes sense to re-evaluate your investment approach and the role of fixed income in your portfolio.

Break it down: Stocks and bonds

Whether you’re looking to create your own portfolio or have someone do it for you, knowing what’s inside is an important step on your investing journey.