Let’s create a retirement plan that’s tailored to you

01 Your goals come first

First, we’ll help prioritize what’s important to you and identify outside factors that may impact your retirement goals.

02 We meet you where you are

We’ll use J.P. Morgan Wealth Plan® to set and track your retirement goals so you know where you stand.

03 Personalize your investing strategy

Together, we’ll look at your current financial picture and develop an investing strategy based on your unique needs.

04 Plan for today and tomorrow

As you near retirement, we can help you stay on track toward your goals.

Discover more ways to plan for your retirement

You deserve a great retirement. J.P. Morgan Wealth Management’s guides, tools and resources can help you get there.

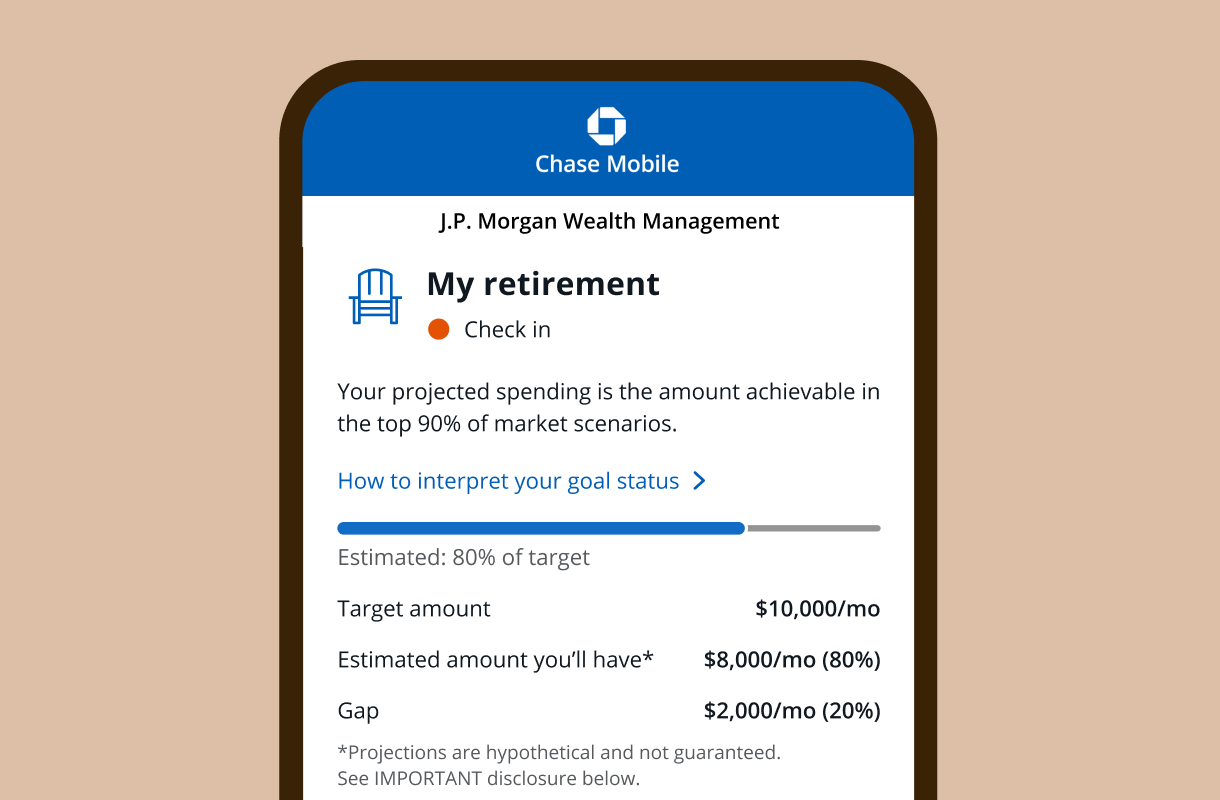

See your goals in action with Wealth Plan

Our award-winning J.P. Morgan Wealth Plan® allows you to track your progress in real time and work with your advisor(s) to adjust your financial strategy as your goals change. You can even schedule a meeting in the Chase Mobile® app or at chase.com.

IMPORTANT: The projections or other information generated by Wealth Plan regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Here’s how we can work together

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Explore our retirement accounts

Roth IRA

Your contributions are not tax-deductible. Your earnings, if any, are tax-deferred and may be withdrawn tax-free if certain conditions are met.

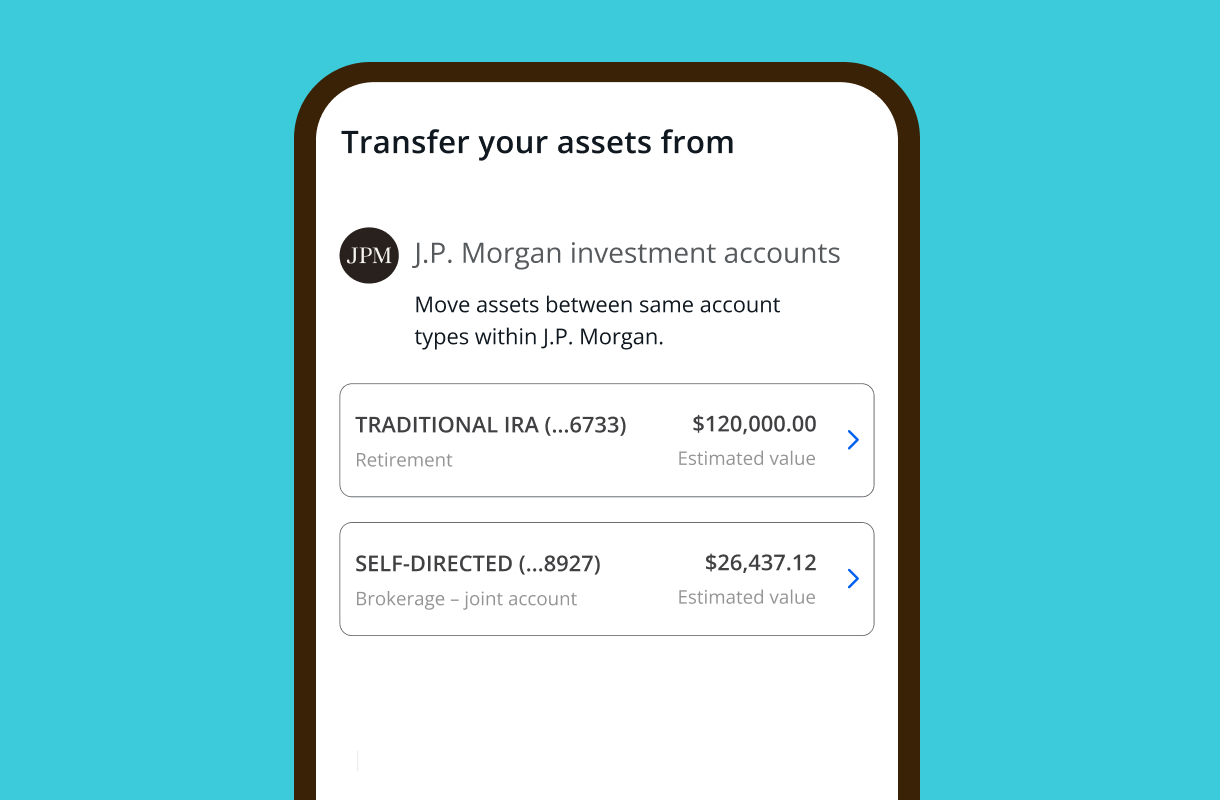

Traditional IRA

Your contributions may be tax-deductible. Your earnings, if any, are tax-deferred and will be included in your taxable income at the time of withdrawal.

Annuities

A long-term, tax-deferred insurance contract that can provide a steady income stream, typically for retirement purposes.

Sharpen your knowledge with the latest news and market commentary

Tap into the latest news and subscribe for market commentary and analysis from J.P. Morgan specialists to help you plan your investment strategy and learn about opportunities.

Start your retirement planning today

Open an account online to start investing on your own, or contact us to work with our advisors to build a personalized financial strategy.