Invest in mutual funds with built-in diversification

Benefit from a professionally managed investment strategy.

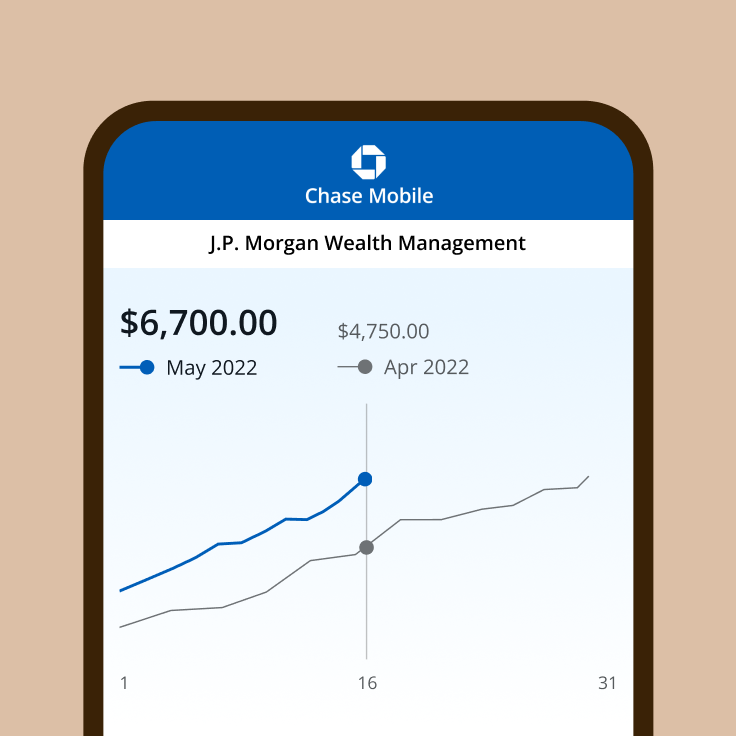

Already have a J.P. Morgan account? Keep an eye on your investments and review your portfolio to help you reach your goals.

Discover mutual funds

What is a mutual fund?

A managed portfolio of securities bought with money from multiple investors. Portfolio managers use that money to invest in a variety of securities, such as stocks, bonds and short-term debt to help meet their clients' goals like growth and/or generating income.

Who are mutual funds for?

Investors looking for a convenient, cost-effective way to diversify their investments across multiple securities with the confidence provided by our professional portfolio managers.

Why invest in mutual funds?

Mutual funds can provide you with a more diversified portfolio than a single stock or bond. They can be cost-efficient because they trade large amounts of securities at once, which lowers transaction costs. Plus, they're managed by financial professionals who research and monitor their performance.

Investing in mutual funds with J.P. Morgan

- Access thousands of different securities through mutual funds from a variety of public companies.

- Use Self-Directed Investing to save money with $0 commission online trades so you keep more of your investment.

- Invest with confidence in mutual funds that our J.P. Morgan Private Client Advisors choose with your goals in mind, across multiple asset classes.

Here’s how we can work together

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest on your own

Build your investment portfolio on your own with unlimited $0 commission online trades. Footnote 1Opens overlay

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Invest with our advisors

Work 1:1 with a J.P. Morgan advisor to receive tailored guidance and build a financial strategy based on what’s important to you.

Already a J.P. Morgan Wealth Management client?

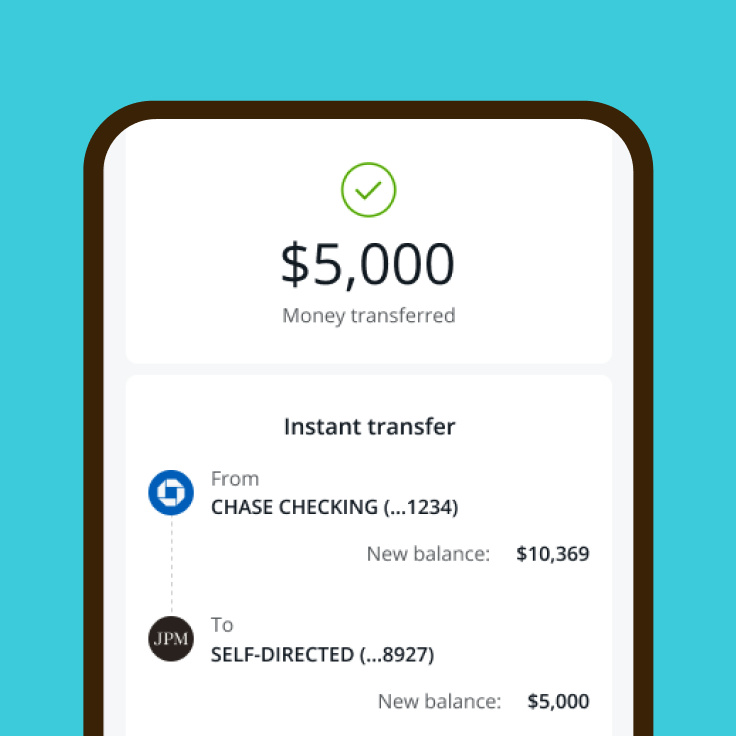

Fund your account

Move cash instantly from a Chase checking or savings account to your J.P. Morgan Wealth Management account—as often as you want.

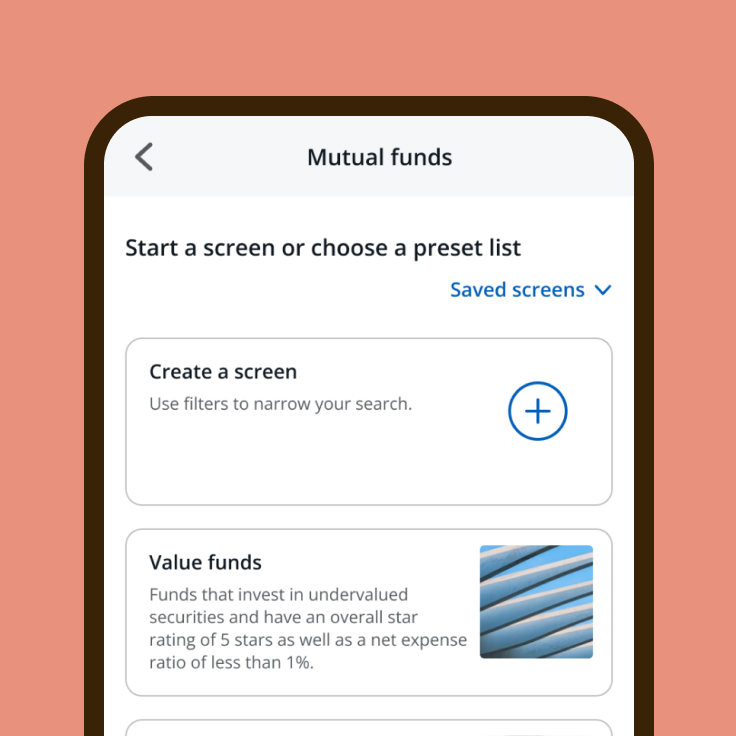

Find mutual funds

Use our screeners to help you find mutual funds that fit your criteria. You can easily add them to your portfolio right in the Chase Mobile® app or at chase.com.

Learn more about our other investment products and accounts

Frequently asked questions

You can diversify your portfolio quickly and easily across many different securities, which can help reduce risk. Mutual funds have low maintenance fees and require small initial investments, so you get cost-effective portfolio management and start investing with as little as $1.

Mutual fund managers combine several securities into one investment portfolio. Investors buy shares of the fund and managers use that capital to invest according to the fund’s objective. Based on the performance of the underlying investments, the value of the fund increases and decreases over time and investors gain or lose capital as a result.

The most common mutual funds are stock or equity funds and bond or fixed-income funds, which target one type of asset. Balanced funds invest in a mixture of stocks and bonds, while money market funds focus on short-term investments issued by the U.S. government or U.S. corporations with high credit ratings.

Passively managed mutual funds aim to provide returns that closely match the performance of a market index like the S&P 500. Actively managed funds typically attempt to outperform an index. This investment approach requires more research and trading than passive management, which often has lower fees.

Capital gains are the profits investors make when a fund sells a security that has gone up in price. These profits are the difference between the purchase price and the selling price, they are distributed to investors proportionally and have a capital gains tax rate.

Start by opening an IRA or general investment account. To invest in a mutual fund, you can work with a J.P. Morgan Advisor or use our Self-Directed Investing tool.

When investing in mutual fund please consider the investment objectives, risks, charges, and expenses associated with the funds before investing. Investment can lose value and those losses are not covered by SIPC.

Some examples of risks to consider are:

Mutual Funds tend to have higher expense ratios and sales charges, because they are actively managed by a portfolio manager, when compared to other investment types which can offset gains.

Tax inefficiency concerns may arise if there are distributions from the funds at the fund management's discretion. This will trigger a tax event for the owner of the mutual fund.

Sharpen your knowledge

Mutual funds: Break it down: Mutual funds vs. ETFs

What's the difference between these two styles of investing? Learn more about the similarities and differences between mutual funds and ETFs here.

Exploring mutual funds (and how to invest in them)

Mutual funds are composed of a mix of assets and offer investors a way to diversify their portfolios. Learn more about them.

Capital gains distributions in mutual funds and ETFs: What to consider

Funds often distribute capital gains toward the end of the year. Understand how this could affect you.