GET READYFund your account to get started

We have 4 easy ways you can contribute to your J.P. Morgan Self-Directed Investing account.

Move cash

Move cash instantly from a Chase checking or savings account to your J.P. Morgan Wealth Management account—as often as you want.

Transfer investments

Move your investments from another financial institution with our simple online tool.

Chase QuickDeposit℠

Deposit checks directly in your general investment account or IRA, right from your phone, in the Chase Mobile® app.

START INVESTINGPlace your first trade to get invested

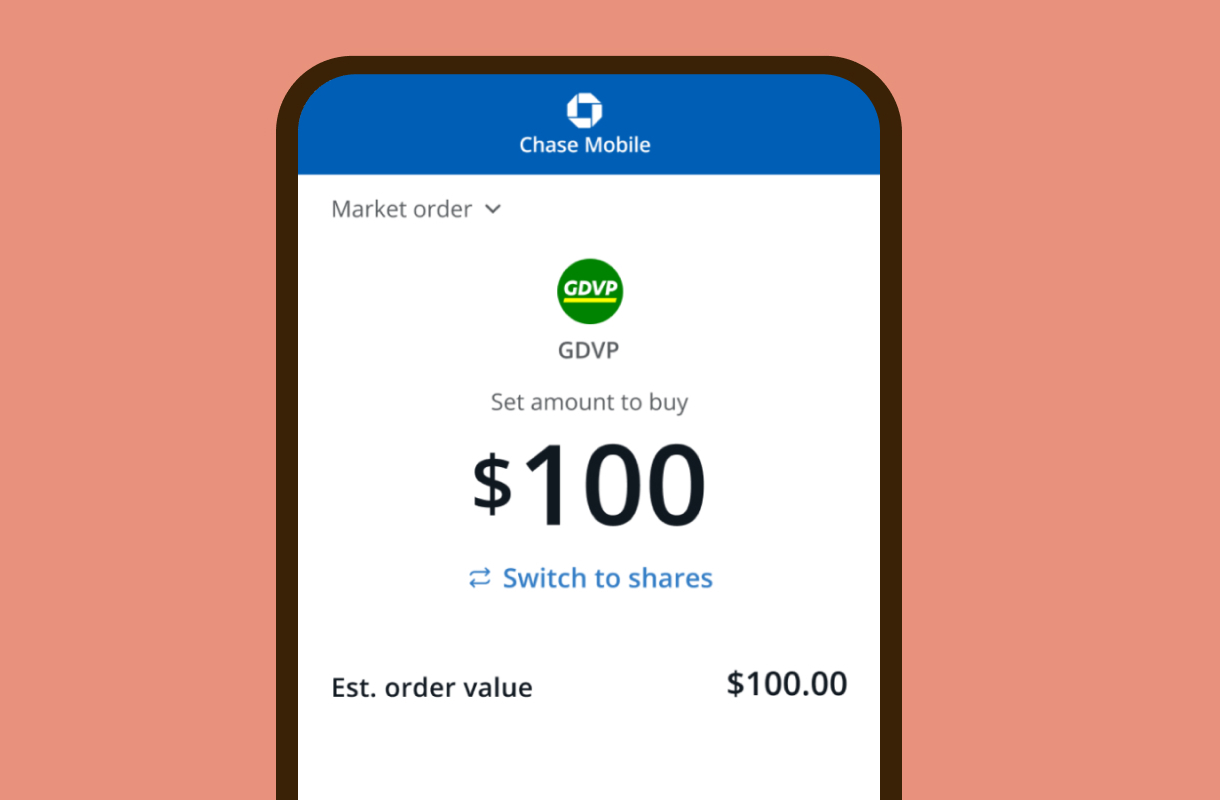

It’s easy to start investing and working toward your goals. With fractional shares, you can trade with as little as $5.

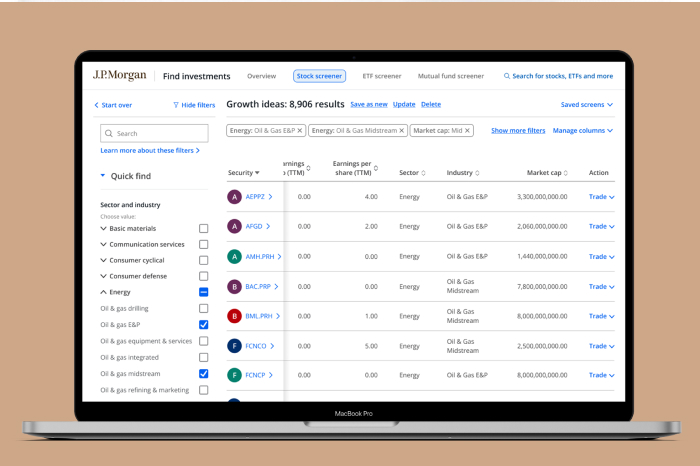

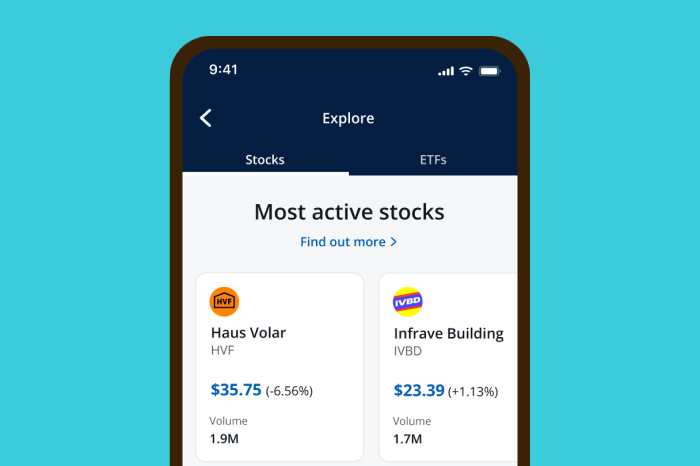

Choose from a wide range of investments

Invest in stocks, ETFs, mutual funds, options, money market funds, treasuries and other fixed income securities and more.

Our tools and insights can help you invest with more confidence

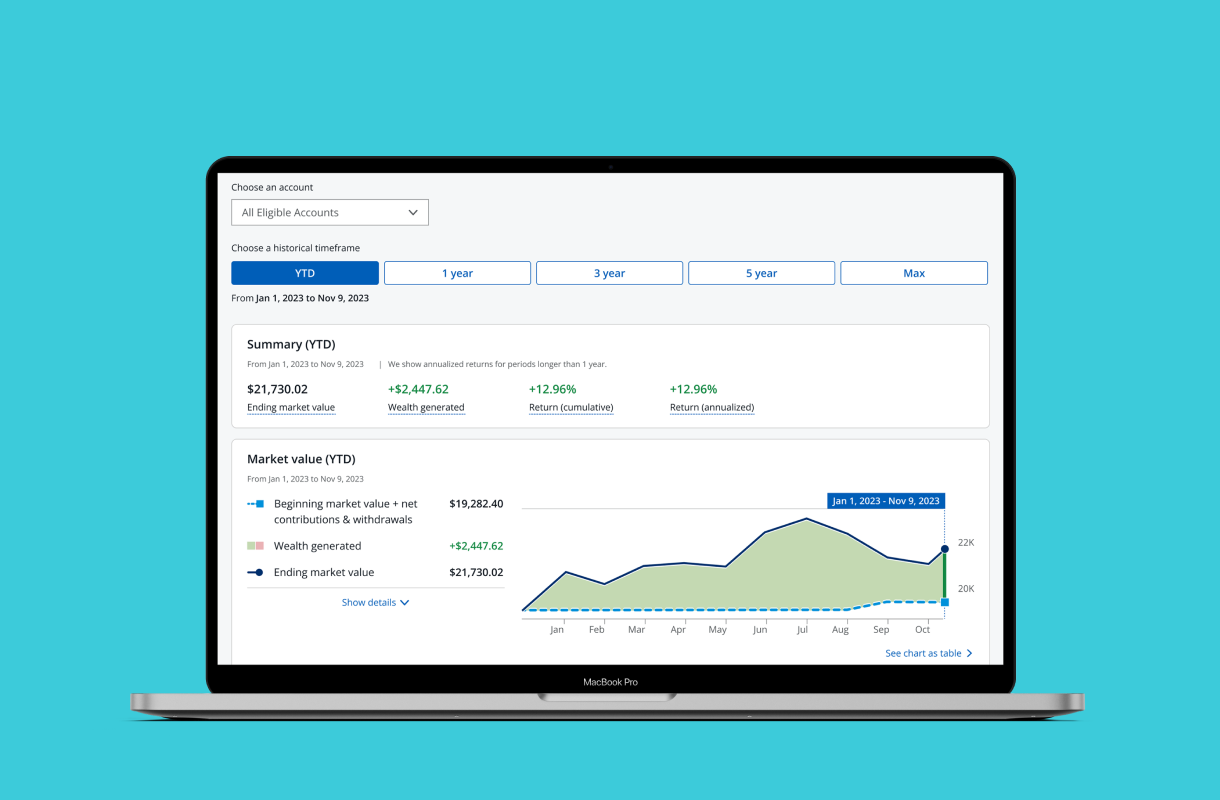

MANAGE YOUR PORTFOLIOManage your investments to stay on track

Keep an eye on your investments and set up your portfolio to help you reach your goals.

Finish setting up your portfolio and stay invested

Schedule transfers

Reach your goals with recurring automatic transfers—from your checking or savings accounts to your investing account.

Watchlists

Create custom watchlists to keep track of potential opportunities and view J.P. Morgan’s price target, rating and upside/downside potential.

Review your beneficiaries

Make sure you know who may be designated to receive the benefits from your investment assets.

Track your progress in Wealth Plan

J.P. Morgan Wealth Plan® makes it easier to see your full financial picture and prioritize your financial goals so you can create a plan to help achieve them.

Have you invested in an IRA?

A 401(k) may not be enough to help you reach your financial milestones. Contributing to a J.P. Morgan IRA can help bring you closer to your retirement goals.

Traditional IRA

Your contributions may be tax-deductible. Your earnings, if any, are tax-deferred and will be included in your taxable income at the time of withdrawal.

Roth IRA

Your contributions are not tax-deductible. Your earnings, if any, are tax-deferred and may be withdrawn tax-free if certain conditions are met.

Not sure if you’re on track to retire?

Run your numbers with our calculators to see how your current plan is working toward your goals.

401(k)/403(b) calculator

Use this calculator to see what your retirement savings may look like when you retire.

IRA calculator

Use this calculator to compare a Traditional and Roth IRA to a general investment account to see how your money can potentially grow over time.

Traditional to Roth IRA conversion

Use this calculator to see the potential future value of your Traditional IRA in comparison to a Roth IRA.

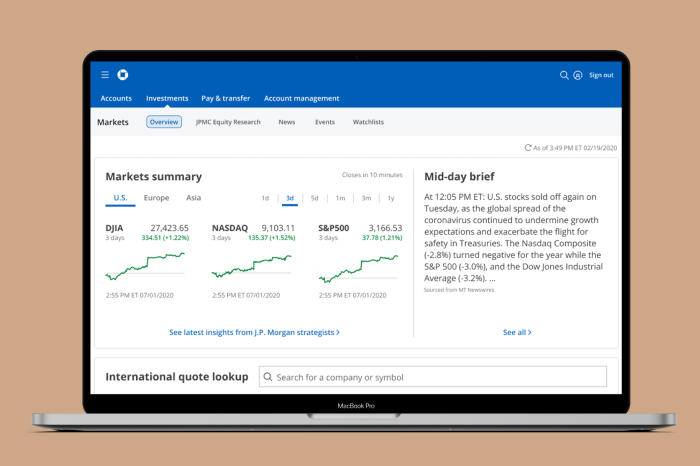

Sharpen your knowledge with the latest news and market commentary

Tap into the latest news and subscribe for market commentary and analysis from J.P. Morgan specialists to help you plan your investment strategy and learn about opportunities.