The 2024 Year-in-Review

We appreciate your partnership with J.P. Morgan Wealth Management. As we step into 2025, let’s reflect on this past year and explore what lies ahead.

A note from our Head of Investment Strategy

Elyse Ausenburgh | J.P. Morgan Wealth Management

They say fortune favors the brave, and that might be the perfect punchline for a review of investing in 2024. Take your pick of the worries investors grappled with throughout the year: Ongoing geopolitical conflicts and threats of escalation. A U.S. election cycle defined by uncertainty and political polarization. Anxiety over lingering inflation pressure and whether the Fed would cut rates soon enough to avoid a recession.

Despite these concerns, markets delivered strong returns to those who were willing to get and stay invested in risk assets. As we close the chapter on 2024, the economic picture shows a healthier balance between growth and inflation. Keep reading to discover more insights and opportunities for the future.

It was a year of big market gains

Inflation cooled, the Fed cut rates, economic activity stayed resilient and events like the U.S. elections failed to slow down momentum.

Source: Bloomberg Financial L.P. as of December 17, 2024

Best performing sectors

- S&P 500 Communication Services: +45.66%

- S&P 500 Information Technology: +38.34%

- S&P 500 Consumer Discretionary: +37.94%

- S&P 500 Financials: +30.18%

- S&P 500 Utilities: +20.33%

Best performing sectors

- S&P 500 Communication Services: +45.66%

- S&P 500 Information Technology: +38.34%

- S&P 500 Consumer Discretionary: +37.94%

- S&P 500 Financials: +30.18%

- S&P 500 Utilities: +20.33%

Worst performing sectors

- S&P 500 Health Care: +1.87%

- S&P 500 Energy: +2.13%

- S&P 500 Materials: +2.55%

- S&P 500 Real Estate: +5.70%

- S&P 500 Consumer Staples: +16.25%

Worst performing sectors

- S&P 500 Health Care: +1.87%

- S&P 500 Energy: +2.13%

- S&P 500 Materials: +2.55%

- S&P 500 Real Estate: +5.70%

- S&P 500 Consumer Staples: +16.25%

Several trends emerged

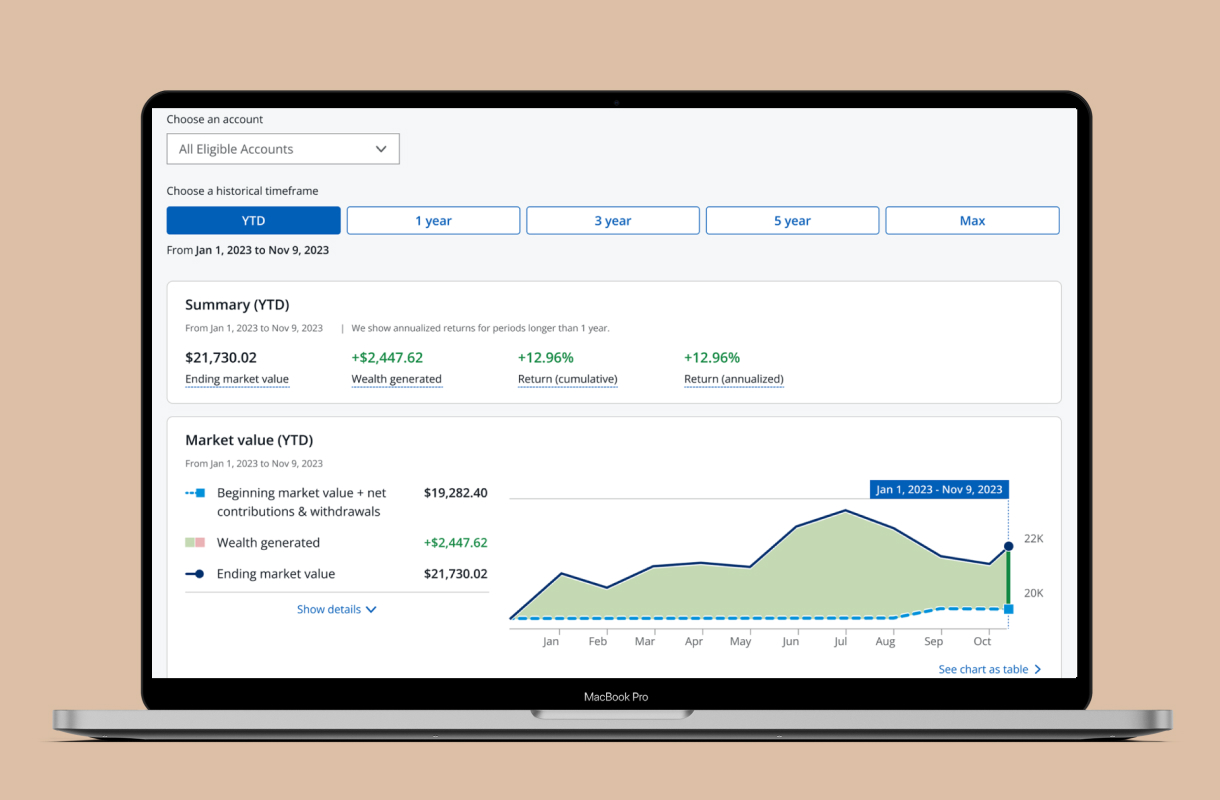

Continuing to build an award-winning investing experience

Thank you for choosing us for your investing journey

J.P. Morgan Wealth Management is dedicated to empowering clients like you with the information and resources needed to grow their wealth. We’ve been doing it for over 200 years, with many more to come.