Social media scams

Alert: For your protection, Chase will not allow you to send Zelle® payments identified as originating from contact through social media

We’ll decline those transactions because Zelle® is meant to pay friends, family and other trusted

recipients you know, not for others you meet on social media

Social media warning:

Nearly 50% of scams reported to Chase originate on social media

Many of our customers are reporting to us that scammers on social media asked them to send their payment with Zelle® or Wires.

Social media is flooded with fake ads for things like merchandise, cars, property rentals and home services. These scams can show up in marketplaces, spoof websites and groups you follow.

Keep in mind that sending money with Zelle® or a Wire transfer is just like sending cash. It's highly unlikely you'll get your money back if something goes wrong.

Know which forms of payments

offer purchase protection

Purchase protection is a benefit you often get with some forms of payment, like credit cards

- This means you could get your money back if you pay for an eligible purchase and don’t receive it.

These forms of payment don’t give you purchase protection:

- Cash

- Checks

- Crypto

- Gift Cards

- Wire Transfers

- Zelle®

This means it’s highly unlikely you’ll get your money back if it’s a scam.

Social media tips:

- Watch out for sellers who require forms of payment that do not provide purchase protection.

- Use a form of payment that does offer purchase protection when sending a deposit for a service.

- Before you pay, always ask yourself: “Am I sure this is not a scam?"

Don't have a false sense of security

when you see listings in groups

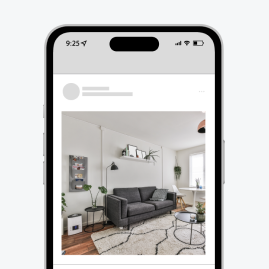

Apartment rentals /

real estate

Scammers will often copy real apartment/real estate listings, steal images and repost the ads to get you to send a deposit that they’ll steal.

Job listings

Fake employment scams steal your identity. They ask you to pay application or job training fees. Others may even give you a job where you end up inadvertently laundering money.

Pets for sale

Scammers will often use tactics that tug on your heartstrings, so ads selling adorable-looking pets that don’t exist is a popular way to lure you in.

Friendships and romances

Scammers may try to build a friendship or romantic relationship over time, earning your confidence before asking you for money for things like health problems or recommending fraudulent investments.

Take a careful look at the ad

Are there any of these red flags?

- Does it look like the photos were simply pulled from the internet?

- Have the pictures been used in other postings online? (You can do an image search to find out.)

- Is the price ridiculously low?

- Does it seem too good to be true?

"Investing" can be risky if:

- It’s recommended by someone you’re romantically involved with, but have never met in person

- The "tip" is provided by someone you met through social media, but have never met in person

- You’re transferring money to a website or company that hasn't been vetted by reputable sources

Bottom line: Investing in anything you hear about on social media or from someone you’ve never met in person increases the risk of your money disappearing.

Sending money to a business on social media can be risky if:

- The same item isn’t for sale at the same price on the company’s legitimate website

- They only allow forms of payment that don't offer purchase protection

There are risks, even when you’re selling

Fake buyers claim they’re ready to pay (or have paid) but they’re ready to scam you instead. Some scammers claim to have overpaid and want you to refund them the difference, but all they’ve sent you is a fake screenshot.

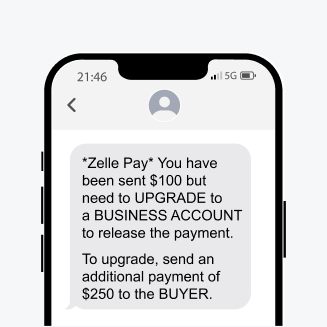

Watch out for these common scams

Upgrade

They claim to have sent the money using Zelle®, then send you a message saying you can only receive it if you upgrade to a "business account."

Tip: Chase and Zelle® will never ask you to send money to "upgrade" your Zelle® account. There is no such thing as an upgraded Zelle® account.

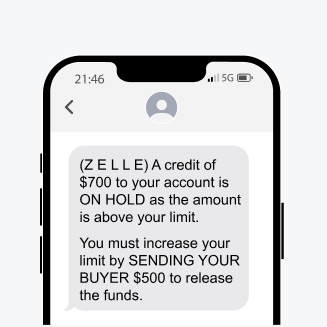

Increase your limit

They claim to have sent the money using Zelle® then send you a message that says you can’t receive the money until you pay to "increase your transaction limit."

Tip: Chase and Zelle® will never ask you to send money to increase your limit.

Always remember:

If you're unsure, walk away

Help protect yourself from social media scams

It’s highly unlikely that you’ll get your money back if you use a form of payment that doesn't provide purchase protection.