Course: What is credit?

How personal scores are calculated

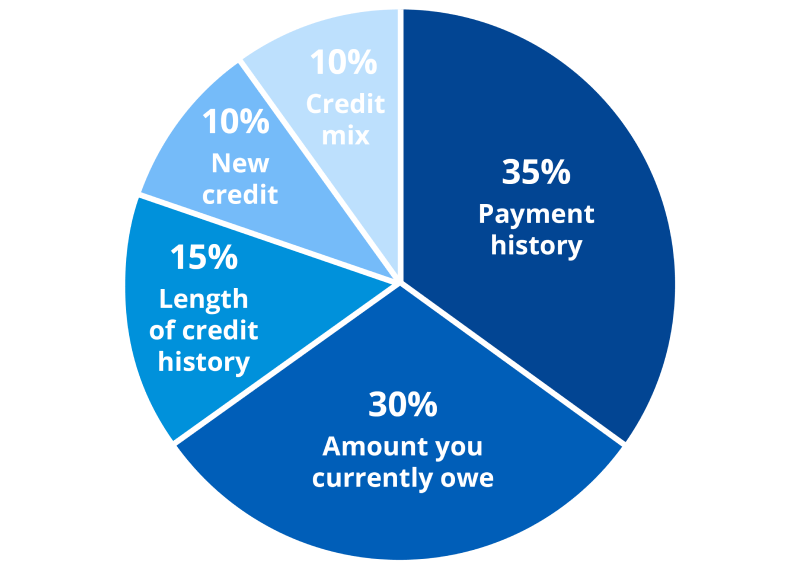

FICO is the most common system used for evaluating someone’s overall credit score, and five factors go into the equation.

What is your track record of paying on time? How many accounts have you opened? How many loans have you had in your name?

What balances are you currently carrying? How much debt are you actively paying on?

The longer you’ve had accounts open and kept them in good standing, the better your score.

How often are you applying for credit or loans? Frequent applications can indicate financial struggles to loan officers and can lower your score.

Lenders like to see that you can manage different kinds of credit successfully, including revolving credit (credit cards, gas cards, lines of credit) and installment credit (car loans and mortgages).