Invoicing solution for small businesses

Invoicing

Fast-track getting paid with our effortless invoicing solution.

Included with your Chase Business Complete Banking® account.

Streamline invoicing and billing and get paid faster with our secure solution

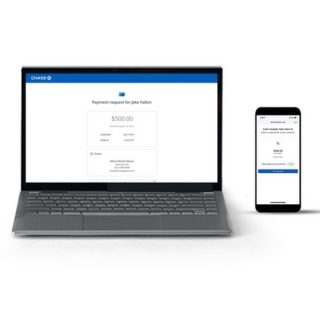

Invoice through your bank account

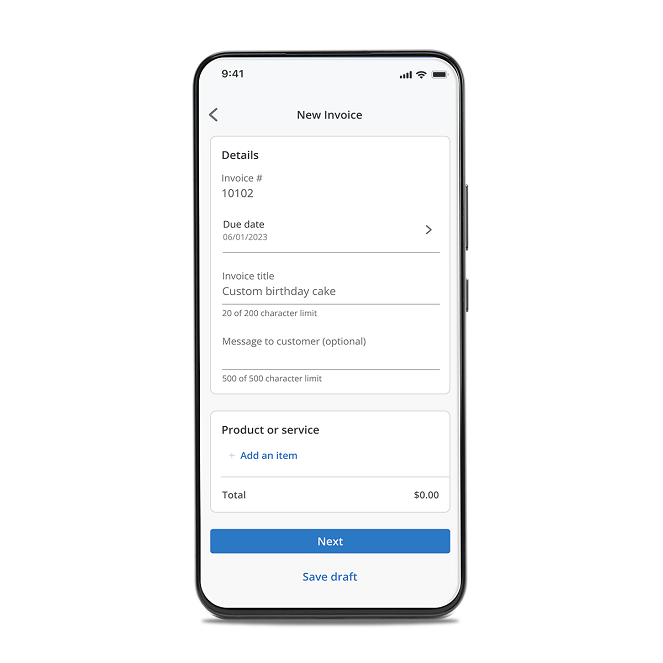

Create invoices in minutes

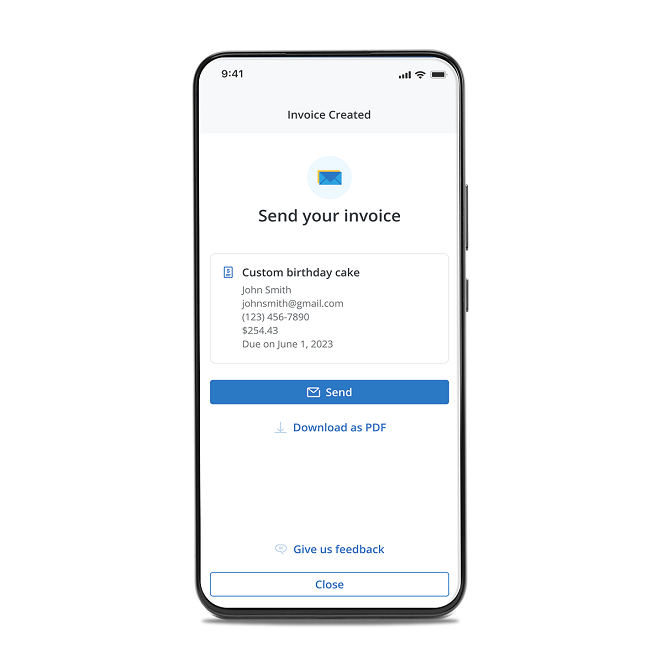

Easily create digital invoices straight from your Chase Business Complete Banking account in Chase Business Online or the Chase Mobile® app. Safely send invoices through a secure link by text or email.

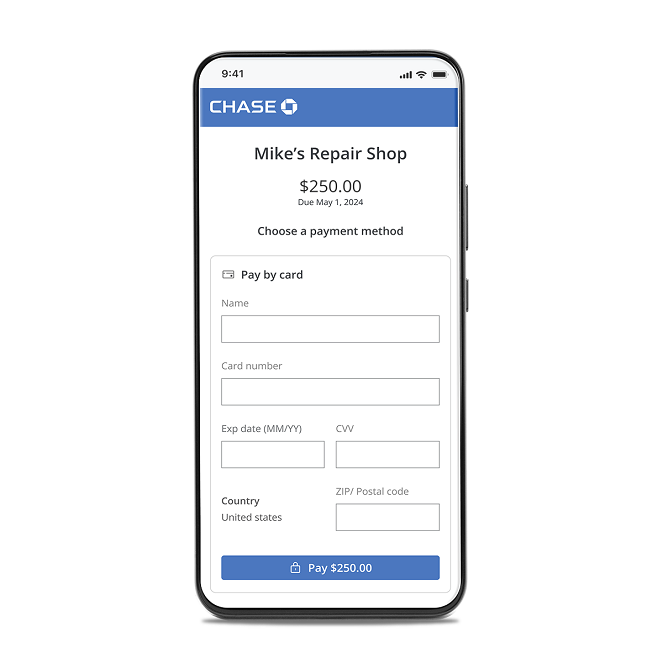

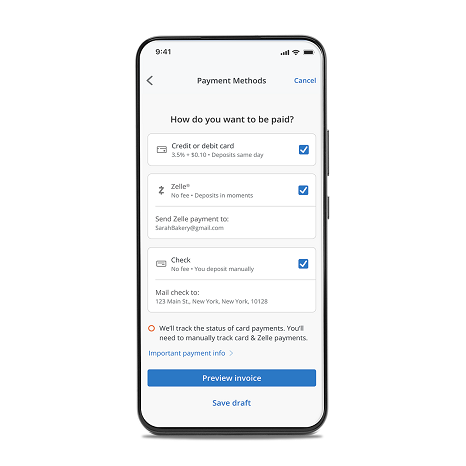

Offer payment choices

Flexible payment options

Give your customers the flexibility to pay how they prefer — by credit or debit card, Zelle®, cash or check so it’s easier for you to get paid fast.

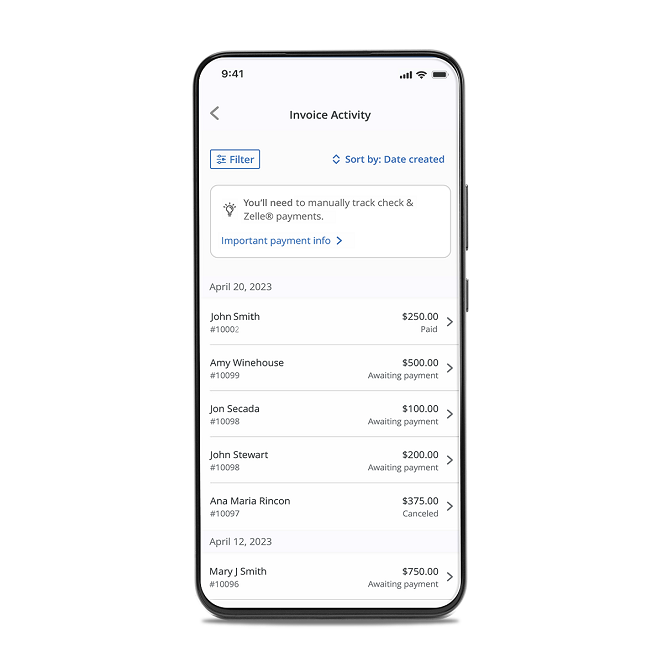

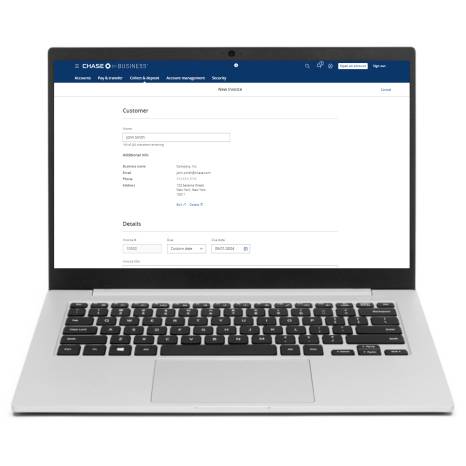

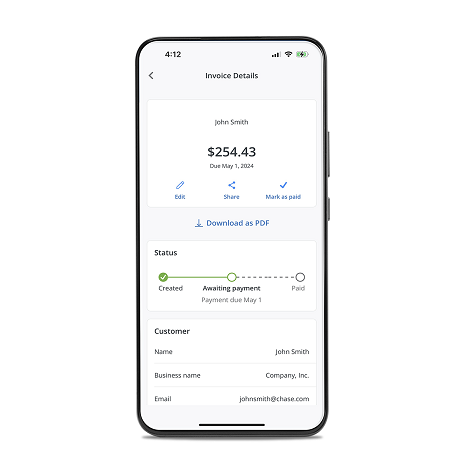

Stay organized and on top of payments

Modern invoicing management

Send invoices and track payment activity in one place for easier cash flow management.

Plus, keep up with payments in real time with automatic reconciliation for card payments.

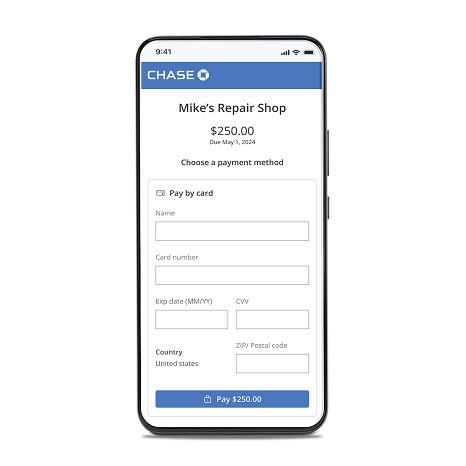

Accelerate cash flow with card payments

Take card payments

Invoices paid by card directly within the payment portal are paid four times faster than other payment methods. Plus, enjoy same-day deposits.

Create invoices at no additional monthly cost

3.5% + 10¢

Card processing rate

There are no processing fees for Zelle® or check.

Enjoy same-day funding at no additional cost when you accept card payments for invoices.

Create an invoice in just a few clicks

Navigate to the Collect & Deposit Center and select Create an invoice on Chase Business Online or in the Chase Mobile app.

Get started with invoicing

New to Chase for Business?

Open a banking account or reach out to a Payments Advisor — call 1-877-843-5690 or fill out this short form.

Chase QuickAccept® — enjoy multiple ways to get paid

Built into your Chase Business Complete Banking account for quick activation and easy management, QuickAccept is a fast and easy way to take card payments, including Invoicing and more. Get fast funding with deposits as soon as the same day.

What's included when you process with Chase

Fast access to cash

Improve your cash flow with same-day deposits, at no additional cost, when you direct your funds to a Chase business checking account.

24/7 customer support

Live expert guidance is available when you need it. Self-service is accessible anytime in the support center.

Sell with confidence

Chase’s fortress-level security, industry-leading systems and Fraud Protection services help keep your payments safe.

More ways to invoice with Chase

Get paid using invoicing software

Authorize.net®

A payment gateway that lets you seamlessly accept credit cards in the U.S. and internationally, and turn your computer into a virtual terminal. Plus, set up recurring billing.

Get started with invoicing

New to Chase for Business?

Open a banking account or reach out to a Payments Advisor — call 1-877-843-5690 or fill out this short form.

Frequently asked questions

Sign in using your Chase Business Complete Banking credentials.

On Chase Business Online:

- Navigate to Collect & deposit.

- Find the Get paid section and choose Get started under Create an invoice.

- Choose Get started to activate invoicing.

On the Chase Mobile app:

- Navigate to Pay & collect and choose Collect & deposit.

- Choose Create invoices.

- Choose Get started to activate invoicing.

There is no hardware required. Invoicing is available at no additional monthly cost through your Chase Business Complete Banking account.

Recurring invoice payments is currently unavailable when you invoice through your Chase Business Complete Banking account. If this is a feature you need, please reach out to a Payments Advisor — call 1-877-843-5690 or fill out this short form to discuss Authorize.net invoicing software.

This invoicing solution allows you to create professional invoices including your business name, a description of service or sale, tax, payment due date and more. You are also able to offer your customers flexibility to pay how they prefer — by card, Zelle® or check. It is a more professional way to request payments, compared to payment links.

Invoices paid by card sync alongside the transactions made using the Chase POS System. However, you cannot create or send an invoice from within the Chase POS app or Chase POS Terminal at this time.

Yes. Chase invoicing solution is designed for small businesses looking to create and send digital invoices.

Chase invoicing includes the following features:

- Add itemization

- Add taxes

- Edit or cancel invoices

- Download invoice in PDF format

- Email receipts to customers

- Same-day funding and automatic reconciliation for card payments

- Manual reconciliation for Zelle® and ACH

At this time, you can include the name of your business and your contact information on your invoice.

There is no additional monthly fee for invoicing. It's available at no additional cost as a feature of your Chase Business Complete Banking account.

Accepting invoice payments by credit or debit card allows you to manage invoices more efficiently. Currently, only card payments are updated and tracked automatically in real time. For Zelle® and check payments, you will need to manually track and update payment status.

Visit our Support site for other commonly asked questions.

Need help with invoicing?

Find the answers you need and get 24/7 merchant support.