Adjustable-Rate Mortgage FAQs

We’re here to help

Understand and prepare for changes to your adjustable-rate mortgage.

ARM FAQs

With a fixed-rate mortgage, the interest rate and your monthly principal and interest payment stay the same throughout the life of your loan. With an adjustable-rate mortgage (ARM), the interest rate changes periodically and your payments may go up or down.

Yes. The terms ARM (adjustable-rate mortgage) and variable-rate mortgage both refer to the type of loan where the interest rate changes periodically.

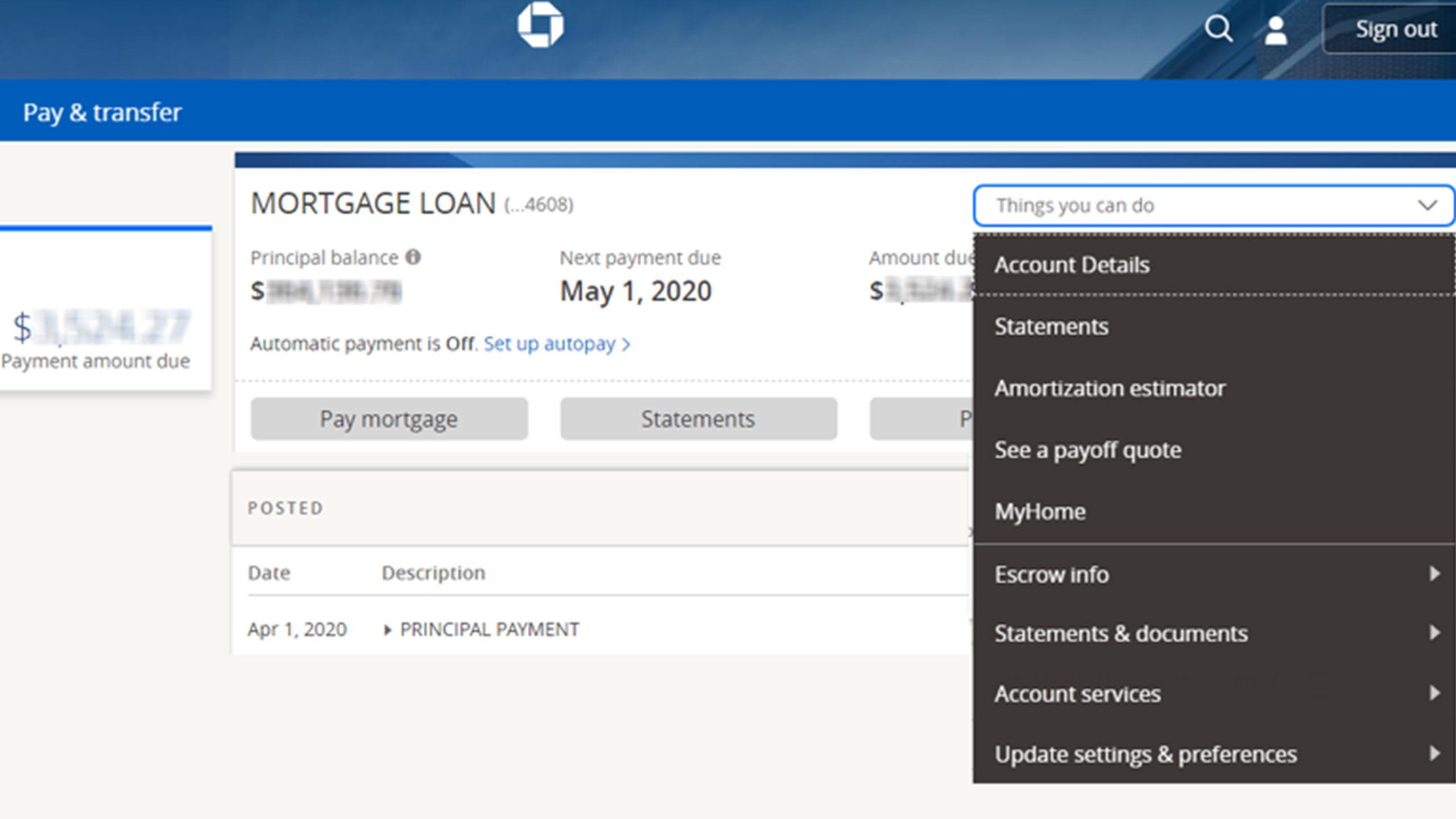

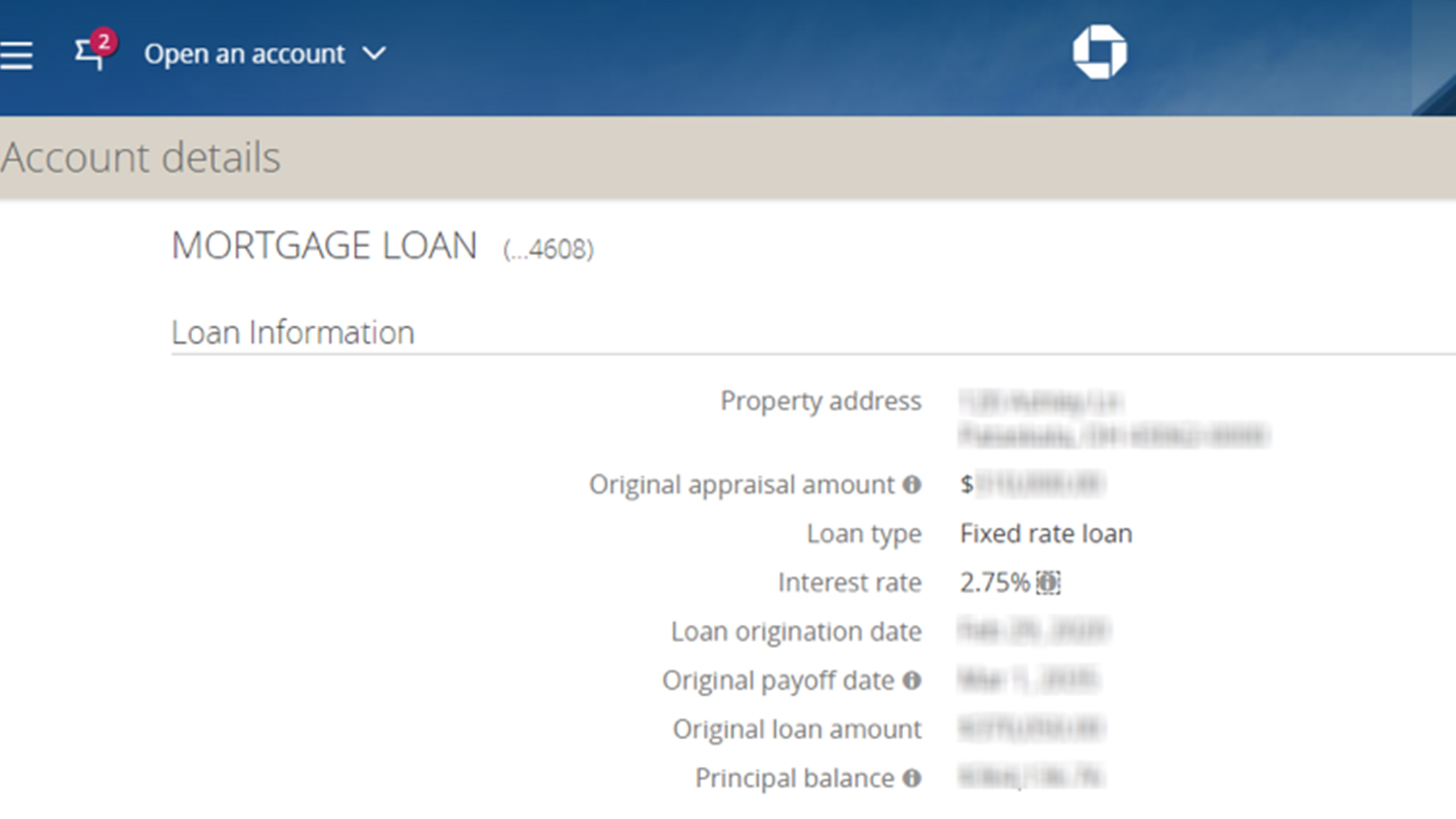

You can view your loan details on chase.com or in your original mortgage documents.

- An index is a benchmark used to determine a baseline interest rate. Every ARM loan is tied to an index. The index for your ARM is listed in your original loan documents.

- Margin is a fixed percentage that is added to the index rate to calculate the new interest rate.

- Index + Margin = Interest Rate.

There are a few ways to stay informed about interest rate changes.

- Sign up for our Adjustable-Rate Mortgage payment adjustment alert. You get to choose how you want to receive each notification—primary email, text (SMS) or both.

- We’ll send information about changes to your interest rate or monthly payment.

When your interest rate adjusts, we also calculate the amount of your monthly payment that will be applied to principal—which is the remaining balance on your loan. To do this, we determine the principal payment amount needed to pay off your remaining balance by the loan maturity date, while taking into account the new interest rate and the need to maintain equal payments.

The interest rate effective date is the day your interest rate will change, while the payment effective date indicates the day your new payment is due. Your payment change date is usually one month after your interest rate effective date.

Yes. ARM loans have a rate limit indicating the maximum interest rate for the length of the loan, as well as the maximum amount your interest rate can increase with each adjustment. Your rate limit information is included in the notices we provide when your rate adjusts. You can also find this information in your original loan documents.

No. If you’re concerned about your ability to make your payment and are interested in a new mortgage loan, explore your options here. If you’re experiencing financial difficulty, view our mortgage assistance options.

Yes. If you have automatic payments set up, even if the money comes from a bank other than Chase, your monthly payment amount will automatically adjust.

If you’re concerned about your ability to make your payment and are interested in a new mortgage loan, explore your options here. If you’re experiencing financial difficulty, view our mortgage assistance options.

Yes. When your new payment is calculated, we complete a new loan amortization schedule. This amortization uses the principal you’ve paid and your new interest rate to calculate your new payment amount. Any additional principal reflected on your account before the amortization is complete will be included in your new payment calculation.

In order for an extra principal payment to be reflected in your new payment amount, it must be received before your new payment is calculated. If your principal payment was posted after this occurred, it will be included the next time your interest rate adjusts.

Your statement will reflect the payment options that are available for your account based on the length of your loan and account balance. Once an option is no longer feasible, it is removed. For example, you’ll no longer see options for paying off your loan in 15 years if you have less than 15 years left.

When your interest rate adjusts, your new payment amount is calculated based on principal and interest. An interest rate decrease can reduce the amount of interest you pay each month. However, the principal payment portion is determined by calculating the monthly amount needed to pay off your remaining balance in equal payments by the maturity date. Your principal payment amount can increase if additional funds are needed to pay off your remaining balance.

Please update your browser.

Please update your browser.