What is considered a good credit score?

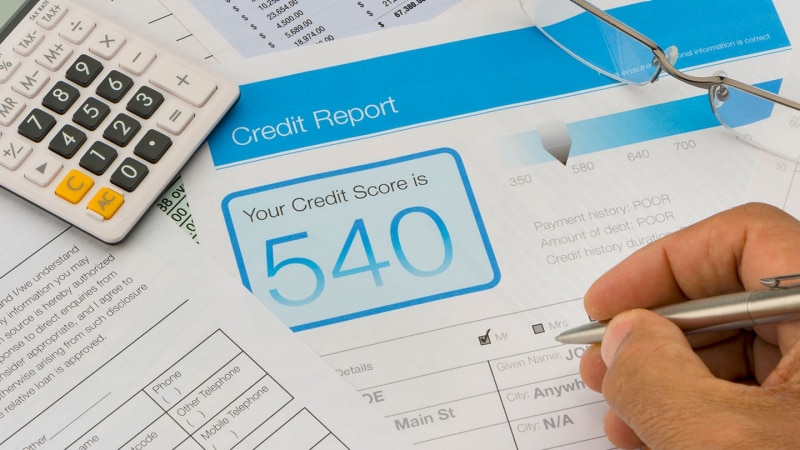

Your credit score is calculated using information like payment history, the amount of debt you owe and the length of your credit history. Each person has a different score depending on how responsible they've been as a borrower. So, what is considered a good credit score?

There are multiple credit scoring models which have different ranges, but generally speaking, scores from 580 to 669 are considered fair, 670 to 739 are considered good, 740 to 799 are considered very good and 800 and above are considered excellent. Higher credit scores usually represent responsible credit behavior.

What's the highest credit score you can have?

If your goal is to obtain the highest credit score possible, you'll have to aim for a score of 850. For most credit-scoring models, including VantageScore® and FICO®, this is the highest score you can achieve. While achieving a perfect credit score may seem like a challenge, it's not impossible.

Making your way to an 850 credit score is rewarding, but isn't necessary. Having a credit score that's in the upper 700s or low 800s shows lenders and other financial institutions that you're a responsible borrower and may help you qualify for the same terms that you would've with an 850.

As long as your credit score is considered good or very good by the three credit bureaus, then you may be eligible for loans you apply for.

Benefits of having good credit

Credit scores give lenders and other financial institutions a snapshot of your overall credit health, so you'll want to maintain a good credit score. This three-digit number gives them a quick understanding of your creditworthiness and how likely you are to repay your debts on time.

Your credit plays a big role when you're trying to do things like finance a car or get a mortgage for your new home. Having a good credit score may make it easier for you to obtain a loan, especially one with lower interest rates. Poor credit may suggest that you're a risky borrower. Credit scores are an important part of your financial health and may unlock many savings and benefits.

A few benefits that come along with having good credit are:

Qualify for lower interest rates

Whether you're looking for a credit card or other type of loan, having a good credit score will most likely increase your chances of qualifying for a better interest rate. Interest rates are one of the costs you pay for borrowing money and are usually tied to your credit score.

Increased chance of being approved for a loan

If you have a poor credit score, you may feel discouraged when it comes to applying for a new credit card or loan since you may be turned down. Having a good credit score doesn't necessarily guarantee approval, but it may increase your chances of being approved for a new line of credit.

Get approved for higher credit card limits

Borrowing capacity is often based on both your income and credit score. Banks are typically willing to lend you more money if your credit score is in good standing. You may be able to get approved for loans with a poor credit score, but the amount you're allowed to borrow may be more limited.

Have more housing options

Many landlords check your credit history when you apply to rent an apartment or house as part of the screening process. A lower score could negatively impact your chances of getting approved. A good score may save you the time and hassle of finding a landlord that will look past the damaged credit. Good credit can also help you get a mortgage on a house.

Look better to potential employers

Some companies may look at your credit reports during a background check when you apply for a job. Your credit scores are calculated based on the information in your credit report. It's possible to get a job with less-than-perfect credit, but some employers may view it as a potential red flag if they see things like late payments or bankruptcies. Checking your credit reports before looking for a job may also help you find any inaccurate information.

5 ways to improve your credit score

Now that you know why having good credit is important, you can take action to improve it over time. Here are a few ways to improve your credit score.

1. Check your credit report

Getting a copy of your credit report and checking for any errors is an important part of monitoring your credit score. It isn't uncommon for consumers to have errors on any of their three major credit reports, so reviewing them may help you avoid this problem and dispute any errors that you come across. You're entitled to a free copy every year from each of the three major credit bureaus.

2. Keep your credit balances below 30 percent

Credit reporting agencies look at the ratio of credit used compared to the amount that is available to you. It's a good idea to keep your credit credit utilization ratio low, or below 30 percent of your available credit. You may be able to do so by paying off your balances, increasing your credit limit, decreasing spending and opening a new line of credit.

3. Pay your bills on time

Making payments on time is one of the most important factors that make up your credit score. Late or missed payments aren't always easy to fix. One way to ensure that all your payments are made on time is by setting up automatic payments. This money transfer is scheduled on a predetermined day to pay your recurring bill.

4. Limit your requests for new credit

Having open accounts is one way to build your credit profile, but you'll want to limit how many applications you submit. Each application may lead to a hard inquiry, which has the potential to lower your credit score. Inquiries can add up and influence your credit score. Opening new accounts may also decrease your average age of accounts.

5. Don't close unused accounts

The longer your credit history, the better. Having long-lasting accounts shows the age of your credit history and a long history may be beneficial. Credit scoring models look at how many accounts you have open, and the balances carried.

Knowing what's considered a good credit score can help you get on the right track to achieving one. Having a high credit score may not be necessary to qualify for loans but it can make a difference.