Checkout with Paze℠

The convenient new online checkout offered by Chase.

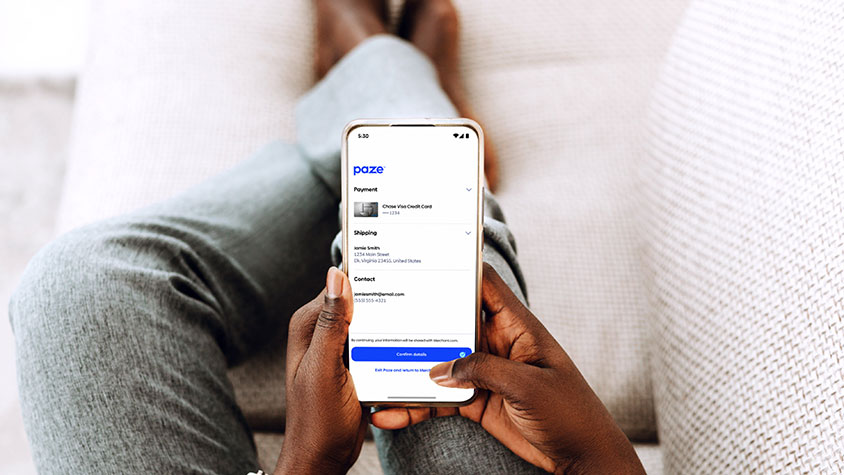

Meet Paze℠, a new online checkout option built for how you shop. By selecting Paze at checkout, you can quickly access all of your eligible Chase credit and debit cards and choose one to complete your purchase.

Benefits of Paze

Added Security

Paze doesn’t share your actual card numbers with online merchants.

Convenience

A fast way to check out. No new apps, Paze usernames, or passwords required. No need to manage cards on online merchants’ sites.

Checkout made easy

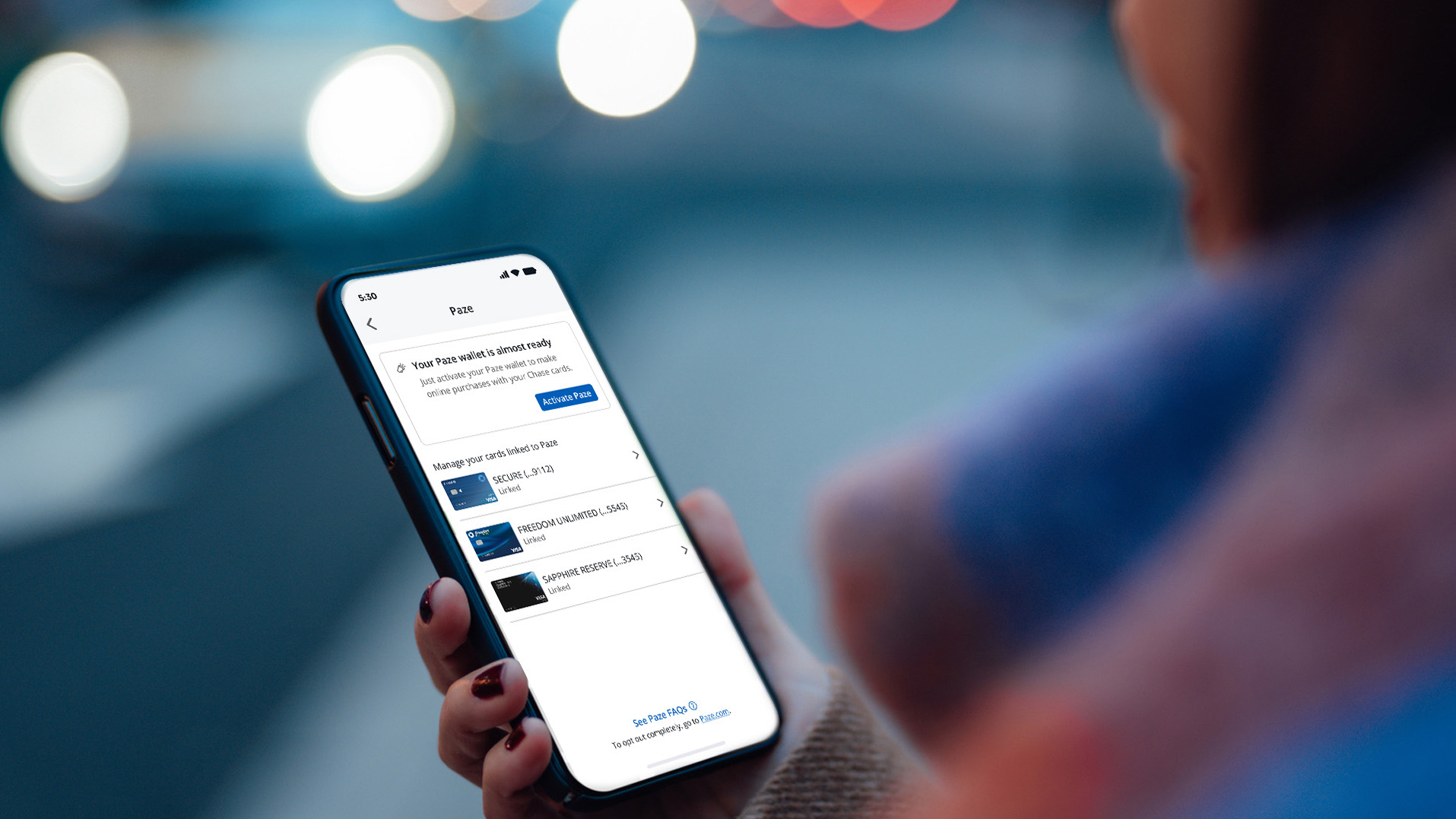

Activate Paze using Chase Online℠, the Chase Mobile® app, or via your first purchase with a participating online merchant—you only have to do this once.

How to use Paze

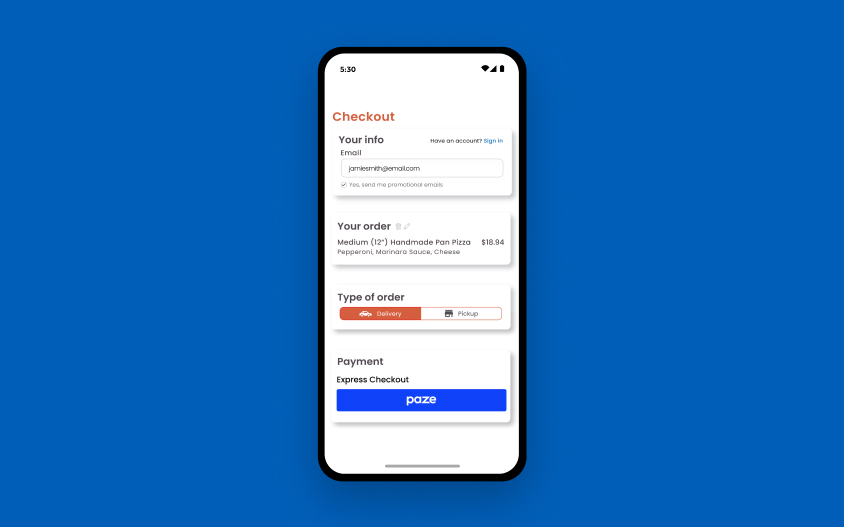

Step 1: Select

Select Paze at checkout the next time you’re shopping with a participating online merchant.

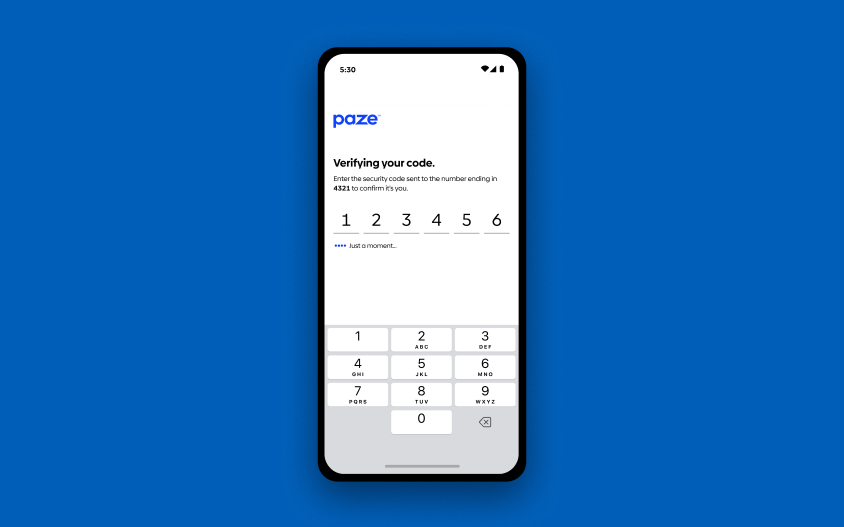

Step 2: Verify

Verify your identity by entering a security code that’s sent to your phone.

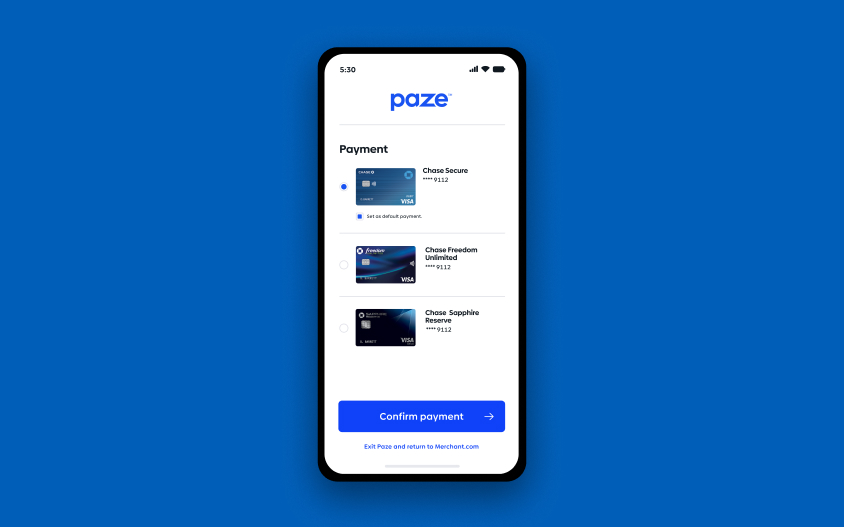

Step 3: Checkout

Choose the eligible Chase credit or debit card you want to use and complete your purchase.

Paze will appear as a payment option at checkout with participating online merchants. Explore participating merchants here.

Who’s eligible to use Paze?

You can use Paze if you’re a current Chase customer with access to Chase Online℠ or the Chase Mobile® app and you’ve used an eligible Chase credit or debit card for a recent online purchase.

What if I want to opt out of Paze?

Contact Chase through the Secure Message Center or by calling 1-800-935-9935 to request that your eligible Chase credit and debit cards are not made available for use.

If your eligible credit or debit cards are already in Paze, you can remove your eligible Chase credit and debit cards at Chase Online℠ or in the Chase Mobile® app. You can also opt out of Paze through mywallet.paze.com.

Frequently Asked Questions

Paze is an online checkout solution provided by Early Warning Services, LLC, with Chase and other participating banks including Bank of America, Capital One, PNC, Truist, U.S. Bank and Wells Fargo. Paze lets you access your eligible credit and/or debit card(s) from all of your Paze participating financial institutions in one place so you can conveniently checkout online with added security, because your actual card number is not shared with merchants.

To use Paze, select it as a checkout option from participating online merchants’ sites. Activate Paze by accepting the terms of use for Paze and confirming your identity. Eligible Chase cards will be shown in Paze. Simply choose the card you want to use and complete your purchase. It's that easy.

You can check out with Paze at any participating online merchant.

Click here to view the list of merchants that offer Paze: Paze.com/merchant-directory

Paze allows you to quickly access your eligible debit and/or credit cards all in one place. It's convenience with added security, because your actual card number is not shared with merchants. Check out online quickly and easily with no additional apps to download, new Paze usernames or passwords to remember. Paze doesn’t share your actual card number with online merchants, so you can browse and buy with confidence.

Currently, existing Chase customers with an online digital profile (i.e., if you signed in to Chase Online℠ or the Chase Mobile® app) who have used an eligible Chase debit and/or credit card for an online purchase are eligible for Paze. Customers who open new eligible credit or debit card accounts and also have an online profile will have the new cards automatically added to Paze. At this time, Paze is not available to Chase customers under the age of 18, business customers, commercial customers, First Republic Bank customers, Private Bank customers, Chase Private Client Privileges card holders, ATM-only card holders, joint checking account debit card holders or credit card authorized users.

Paze works with many major credit and debit cards from participating U.S. financial institutions. Existing eligible consumer (not business or commercial) cards can be used with Paze at this time and will only appear in Paze if the card has recently been used for an online purchase. Chase First Banking℠ debit cards, Chase High School Checking℠ debit cards, Chase business credit cards (such as Ink Business℠), Private Bank credit and debit cards, Chase Private Client Privileges cards, joint checking account debit cards, ATM-only cards, First Republic Bank debit cards, and authorized user cards are not eligible.

There is no additional cost to use Paze. You'll remain responsible for normal card charges, if any, such as interest on revolving balances or applicable fees, etc. The terms of your applicable cardmember or account agreement, including any account related fees, apply.

When you use Paze, online merchants won't see your card numbers. Paze replaces your sensitive card data with a token, which offers a unique set of random letters and numbers and is what is used when you make a payment with that online merchant. The token replaces your card information which provides added security when stored with Paze, because your actual card number is not shared with merchants.

Purchases made with your Chase credit and/or debit cards have Chase Zero Liability Protection for unauthorized card transactions. This means that you won’t be liable for any unauthorized transactions as long as they are reported promptly. Certain limitations apply. Please see your credit card and/or deposit account agreement for details.

See the full list of Paze FAQ on Paze.com.

If you’d like to remove existing Chase credit and/or debit cards in Paze, you can remove them in the Chase Mobile® app within Digital Wallets and Paze. If you don’t want your eligible Chase debit or credit cards automatically linked to Paze, contact Chase through the Secure Message Center or by calling 1-800-935-9935.

You are able to opt out entirely across all participating banks at mywallet.paze.com/footerOptOut. Opting out at mywallet.paze.com will delete all cards and prevent cards from being automatically added by any bank or credit union who offers Paze now or in the future.

If you have additional questions, please contact your participating bank or credit union.

You can manage your Chase cards in Paze at Chase Online℠ or in the Chase Mobile® app. You can manage your entire Paze experience at Paze.com.

You don't need to sign up or download a new app, just look for the Paze logo when you check out at a participating merchant or enter the email address you use with your bank or credit union when shopping online.