- groups

- investments

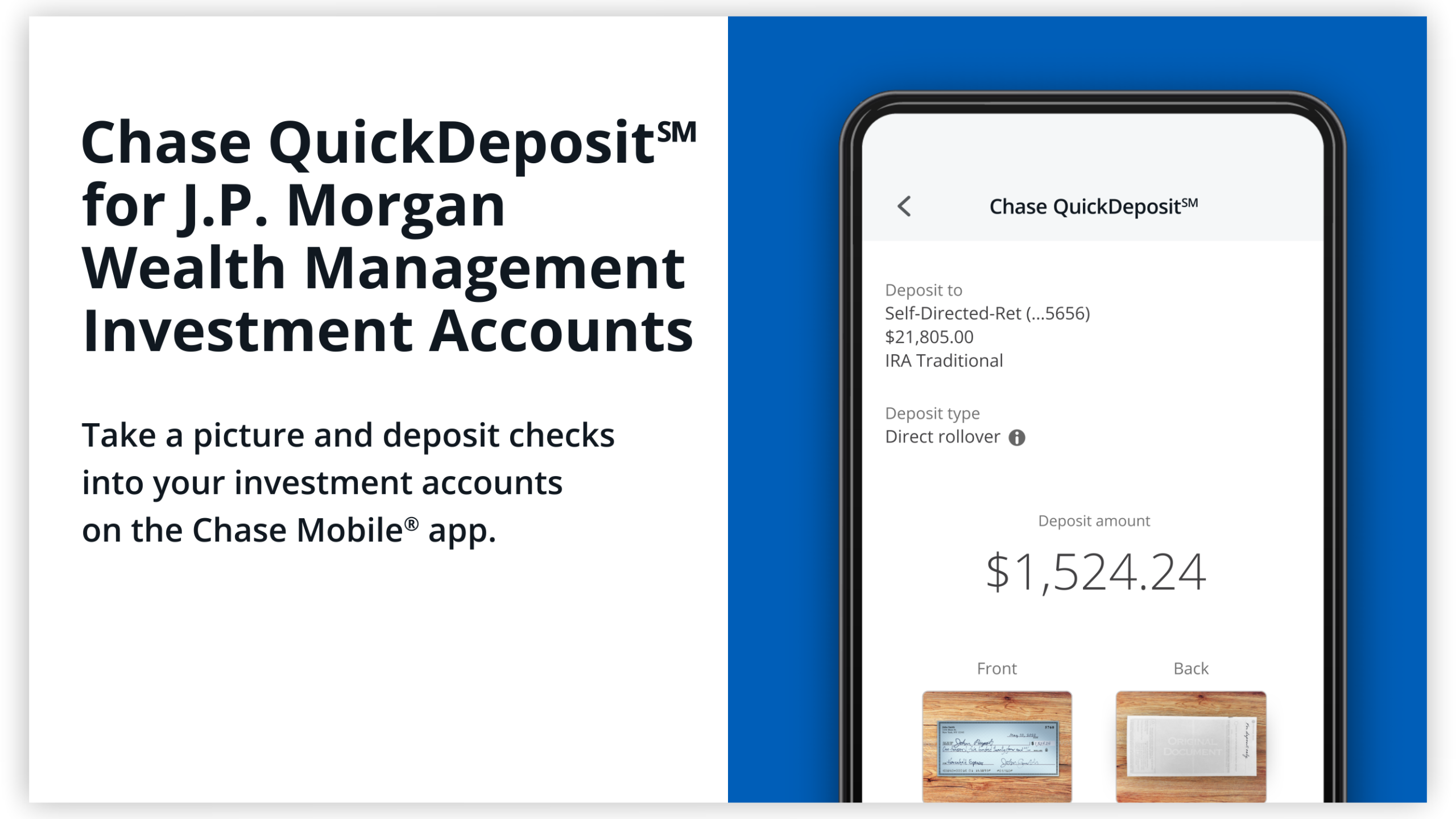

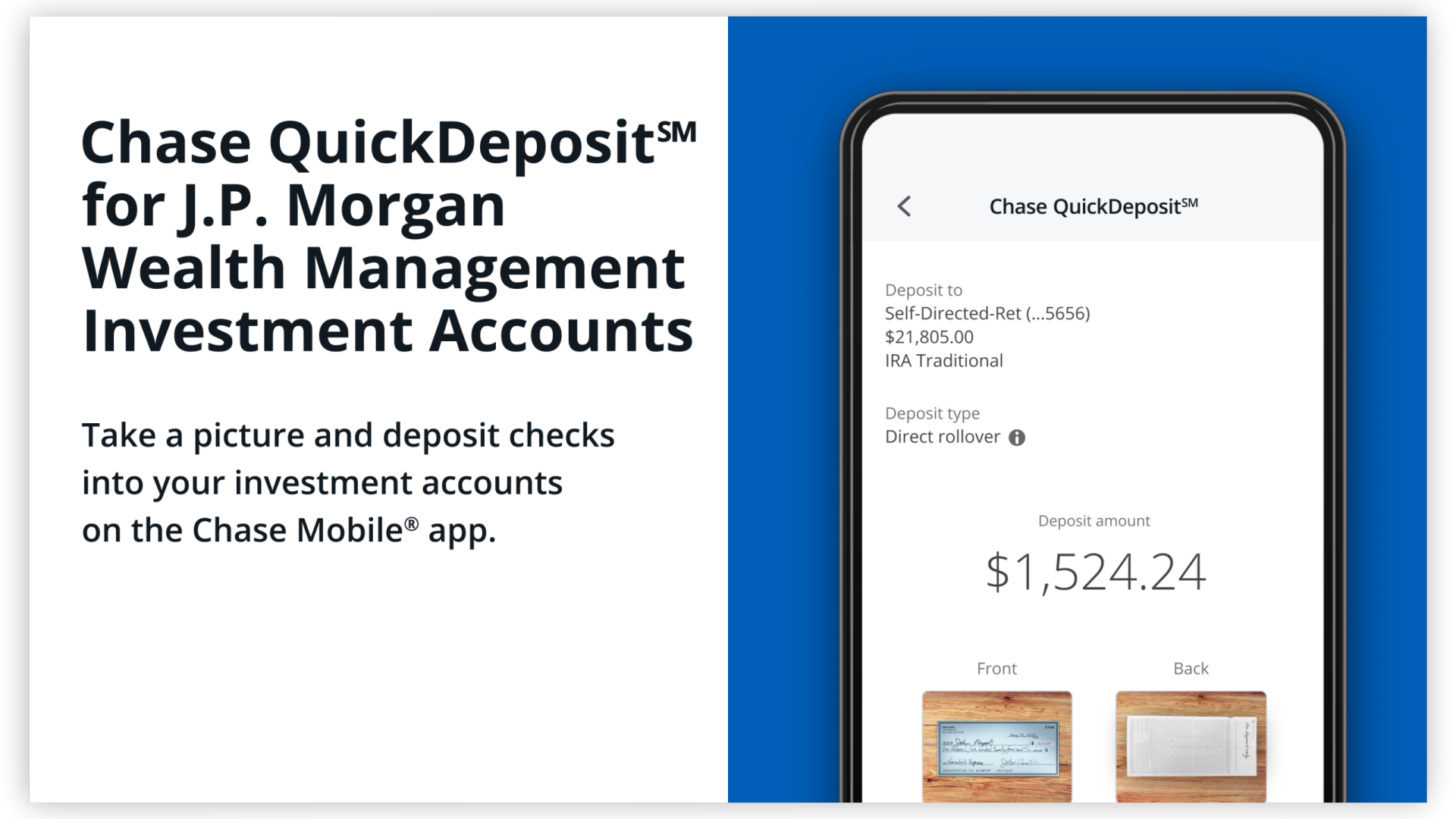

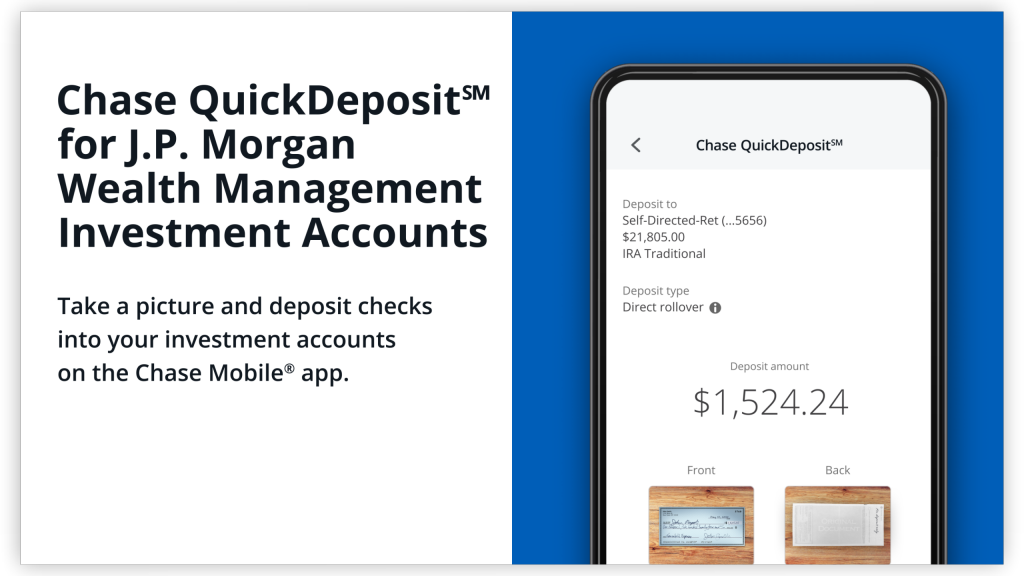

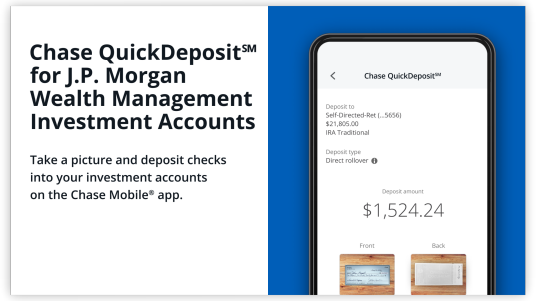

- Chase QuickDeposit℠ for J.P. Morgan Wealth Management Investment Accounts

Chase QuickDeposit℠ for J.P. Morgan Wealth Management Investment AccountsVideo

Account Id: 4394098893001

Player Id: bb60d070-b695-4c55-9162-a421ad370a53

Video ADA Text: Chase QuickDeposit℠ for J.P. Morgan Wealth Management Investment Accounts video

Transcript Browser Title: Video Transcript: Chase QuickDeposit℠ for J.P. Morgan Wealth Management Investment Accounts

Description:

English

English

Video Id: 6324300491112

Audio Description Video Id: 6324308531112

Length (seconds): 128

Transcript: <h2>Note:</h2>

<p>This video uses text and a mobile device displaying the Chase Mobile app to convey information.</p>

<p>Cheerful music plays.</p>

<h2>On screen:</h2>

<p>An illustration of a lightbulb appears, with the opening text:</p>

<h2>On screen:</h2>

<p>Helpful Tips.</p>

<h2>On screen:</h2>

<p>A mobile device displays the word Chase and the Chase octagon symbol.</p>

<h2>On screen:</h2>

<p>Chase QuickDeposit℠ for J.P. Morgan Wealth Management Investment Accounts.</p>

<p>Take a picture and deposit checks into your investment accounts on the Chase Mobile<sup>®</sup> app.</p>

<h2>On screen:</h2>

<p>Legal disclosures:</p>

<p>Investment and Insurance Products:</p>

<ul>

<li>NOT A DEPOSIT</li>

<li>NOT FDIC INSURED</li>

<li>NOT ISSUED BY ANY FEDERAL GOVERNMENT AGENCY</li>

<li>NO BANK GUARANTEE</li>

<li>MAY LOSE VALUE</li>

</ul>

<h2>On screen:</h2>

<p>Now, the mobile device displays the Chase Mobile app's sign-in screen.</p>

<h2>On screen:</h2>

<p><strong>Sign in</strong> to your Chase Mobile<sup>®</sup> app.</p>

<h2>On screen:</h2>

<p>A cursor fills in a user name and password and then taps the "sign in" button. The Chase Mobile app dashboard appears, displaying information about different Chase accounts and how to open an account. The bottom of the screen displays four buttons marked:</p>

<ul>

<li>Accounts;</li>

<li>Pay & Transfer;</li>

<li>Plan & Track;</li>

<li>(and) Investments.</li>

</ul>

<h2>On screen:</h2>

<p>The image presented is for illustrative purposes only and is not intended to represent any actual client account.</p>

<h2>On screen:</h2>

<p>Tap <strong>Pay & Transfer.</strong></p>

<h2>On screen:</h2>

<p>The cursor taps that button and then a screen appears labeled: "Pay & Transfer." The screen displays six buttons marked:</p>

<ul>

<li>Pay bills;</li>

<li>Send money with Zelle;</li>

<li>Wire money;</li>

<li>Transfer;</li>

<li>Request and/or Split with Zelle;</li>

<li>(and) Deposit checks.</li>

</ul>

<h2>On screen:</h2>

<p>The screen displays three buttons marked:</p>

<ul>

<li>See activity;</li>

<li>Manage recipients;</li>

<li>(and) Settings.</li>

</ul>

<h2>On screen:</h2>

<p>Tap "Deposit checks."</p>

<h2>On screen:</h2>

<p>The cursor taps the "Deposit checks" button and then a screen appears labeled: "Choose an account." The screen displays:</p>

<ul>

<li>information about two checking accounts;</li>

<li>(and) a menu button marked "Deposit to investment accounts."</li>

</ul>

<h2>On screen:</h2>

<p>Tap <strong>"Deposit to investment accounts."</strong></p>

<h2>On screen:</h2>

<p>The cursor taps that button and then a screen appears labeled: "Choose an investment account." The screen displays:</p>

<ul>

<li>information about two investment accounts;</li>

<li>(and) a button marked "Deposit to Individual Retirement Account (IRA)."</li>

</ul>

<h2>On screen:</h2>

<p>Choose the account where you want your deposit to go. For IRAs, tap <strong>"Deposit to Individual Retirement Account (IRA)."</strong></p>

<h2>On screen:</h2>

<p>The cursor taps that button and then a screen appears labeled: "Choose your deposit type." It displays information about different deposit types. At the bottom of the screen is a button marked "Get Started."</p>

<h2>On screen:</h2>

<p>For IRA deposits, choose a type:</p>

<ul>

<li>Contribution;</li>

<li>Direct rollover;</li>

<li>Indirect rollover;</li>

<li>Direct transfer.</li>

</ul>

<p>Not sure about your deposit? Tap "<strong>Get started</strong>."</p>

<h2>On screen:</h2>

<p>The cursor taps on the "Direct rollover" clickable tile and then a confirmation pop-up box appears, displaying buttons marked "Confirm," and "Cancel."</p>

<h2>On screen:</h2>

<p>Once the deposit type is selected, tap <strong>"Confirm."</strong></p>

<h2>On screen:</h2>

<p>The cursor taps the "confirm" button and then the confirmation box disappears. A screen appears labeled "How was your 401(k) or other employer-sponsored retirement plan funded?" The screen lists different options.</p>

<h2>On screen:</h2>

<p>Follow the prompts based on the deposit type selection.</p>

<h2>On screen:</h2>

<p>The cursor taps on a button marked "Traditional payroll deductions or employer contributions (pre-tax)" and then a screen appears labeled: "Choose an Account - Deposit type: Direct Rollover." The screen displays a clickable tile with information about an IRA traditional account. The screen also displays a tile showing legal disclosures.</p>

<h2>On screen:</h2>

<p>Choose the account where you want your deposit to go.</p>

<h2>On screen:</h2>

<p>The cursor taps on the "IRA traditional account" button and then a screen appears displaying a fillable field to enter a deposit amount. The screen displays buttons marked:</p>

<ul>

<li>Front;</li>

<li>Back;</li>

<li>(and) Next.</li>

</ul>

<h2>On screen:</h2>

<p>Enter the deposit amount and tap "<strong>Front</strong>." Current deposit limits vary by account type.</p>

<h2>On screen:</h2>

<p>The image presented is for illustrative purposes only and is not intended to represent any actual client account.</p>

<h2>On screen:</h2>

<p>The cursor types in a deposit amount of $1,524.24 and then taps on the button marked "Front." The mobile device (now positioned horizontally above a personal check) displays a screen labeled: "Capture. Confirm. Deposit." At the bottom of the screen, two buttons are labeled: "Manual Capture" and "Auto Capture."</p>

<h2>On screen:</h2>

<p>We'll take the picture of the check for you if you select: "<strong>Auto Capture</strong>."</p>

<h2>On screen:</h2>

<p>The cursor clicks the button marked "Auto Capture." Now, the mobile device functions as a camera, with a clear rectangular field framing the center of its screen to take a picture of the $1,524.24 check.</p>

<h2>On screen:</h2>

<p>Center the check within the frame and when it looks good, we'll take the picture automatically.</p>

<h2>On screen:</h2>

<p>Check image is simulated.</p>

<h2>On screen:</h2>

<p>The mobile device automatically photographs the check. Now a black screen appears displaying instructions and a blue button marked "Next."</p>

<h2>On screen:</h2>

<p>Sign the back of your check and write: <strong>"For deposit only."</strong> Select "<strong>Next."</strong></p>

<h2>On screen:</h2>

<p>The cursor clicks the "Next" button and then the mobile device functions as a camera, again. It hovers over the <strong>back</strong> of the check.</p>

<h2>On screen:</h2>

<p>Now, center the back of the check within the frame.</p>

<h2>On screen:</h2>

<p>The mobile device automatically photographs the check. Now, the mobile device screen (positioned vertically, again) displays both photos of the check, front and back. A button marked "Deposit" is at the bottom of the screen. The screen also displays the check's:</p>

<ul>

<li>Deposit amount;</li>

<li>Routing number;</li>

<li>(and) Account number.</li>

</ul>

<h2>On screen:</h2>

<p>Make sure your deposit amount and account details are correct. Tap <strong>"Deposit,"</strong> then <strong>"Yes"</strong> to confirm.</p>

<h2>On screen:</h2>

<p>The cursor clicks on "Deposit" and then a verification pop-up box appears, labeled "Deposit this check?" The box displays:</p>

<ul>

<li>information about the check:</li>

<li>(and) two buttons marked "Yes" and "Cancel."</li>

</ul>

<p>The cursor taps on "Yes" and then a confirmation screen appears, labeled: We received your check - $1,524.24. At the bottom of the screen, two buttons are marked:</p>

<ul>

<li>Deposit another check;</li>

<li>(and) Close.</li>

</ul>

<h2>On screen:</h2>

<p>Success! You can <strong>Deposit another check</strong> or tap <strong>"Close." </strong>Deposits made before 8 p.m. ET on business days will typically be available to invest within one business day. Wait for 8 business days before you destroy the check.</p>

<h2>On screen:</h2>

<p>After you complete your transaction, write "deposited" and the date of the deposit on the face of the check. Please retain the marked check for 8 business days or until you receive our notification that your Chase QuickDeposit℠ has been accepted. After that time, you may destroy it.</p>

<h2>On screen:</h2>

<p>There's so much more you can do! We'll teach you how at <strong> chase.com/HowTo</strong>.</p>

<h2>On screen:</h2>

<p>Logo: The word Chase and the Chase octagon symbol appears on the mobile device.</p>

<p>J.P. Morgan Wealth Management.</p>

<h2>Note:</h2>

<p>Legal disclosures appear.</p>

<h2>On screen:</h2>

<p>This video is provided for informational purpose only and actual experience may vary. The information contained herein is as of the date of this publication and J.P. Morgan does not undertake any obligation to update such information. This video does not constitute advice by or on behalf of J.P. Morgan, and nothing in this video should be construed as legal, regulatory, tax, accounting, investment or other advice.</p>

<p>Chase Mobile® app is available for select mobile devices. Enroll in Chase Online℠ or on the Chase Mobile® app. Message and data rates may apply.</p>

<p>Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.</p>

<p>J.P. Morgan Wealth Management is a business of J.P. Morgan Chase and Co., which offers investment products and services through <strong>J.P. Morgan Securities LLC </strong>(JPMS), a registered broker-dealer and investment adviser, member of FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.</p>

<p>© {{copyrightCurrentYear}} JPMorgan Chase & Co.</p>

Thumbnail

mega-medium

2560x1440

2560x1440

desktop-medium

1920x1080

1920x1080

tablet-medium

1024x576

1024x576

mobile-medium

654x367

654x367

mega-small

536x301

536x301

desktop-small

288x162

288x162

tablet-small

288x162

288x162

mobile-small

288x162

288x162

English

English